Analyzing UK Trade Routes: Price Dynamics and Market Imbalances

Week - 16 - Facts, figures and insights into this key market characteristic

A few weeks ago, we shared our insights on the UK transport market, revealing that the UK has one of the most significant in-/outbound rate imbalances compared to other European countries. Today, we want to revisit the region and dive deeper into local specifics, focusing on pricing fluctuations for inbound and outbound transports, alongside the persistent imbalance that defines this market.

Our evaluation encompasses a range of key origin and destination countries, including France, Germany, Belgium, Netherlands, and Poland. This selection represents the UK's most significant trade partners on the continent, capturing the dynamics of goods flowing both to and from the islands.

Source: Transporeon Market Insights

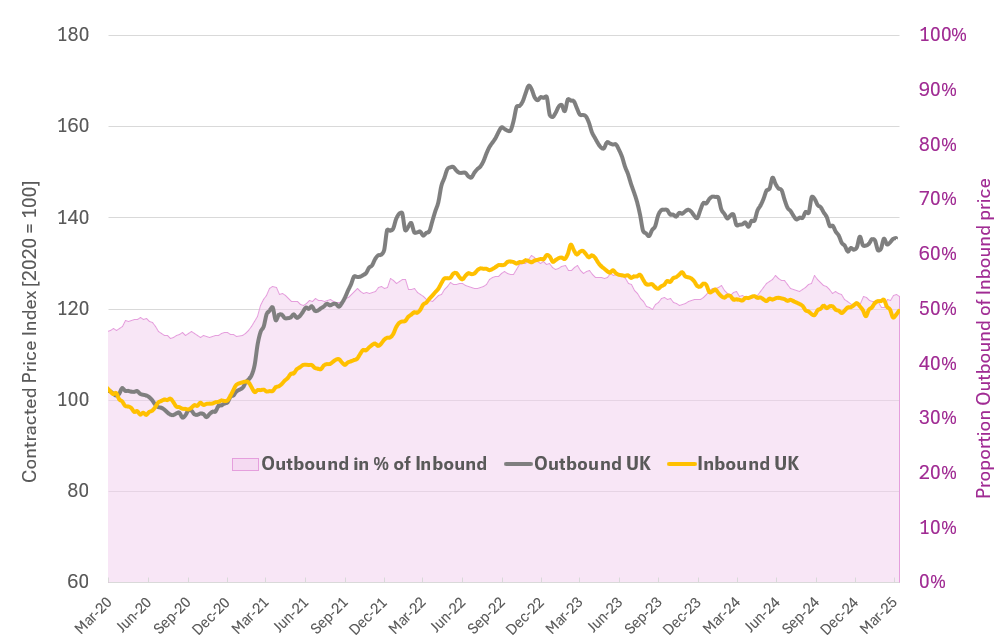

The accompanying chart offers two views: firstly, it shows the index based trend of full-truck-load contracted prices over the past five years for both inbound and outbound transports; secondly, it measures the imbalance by comparing outbound prices to inbound prices. Outbound and Inbound index values allow development comparisons only; they don’t show absolute price levels. For a long time already, since the transition of the country to a service-dominated economy, the amount of goods imported from Europe mainland to Britain significantly exceeds the amount of goods sent back, creating a measurably higher demand and rates for UK inbound transports. Consequently, outbound rates are half as expensive as inbound rates as the 50% suggests.

While avoiding the overused narratives of Brexit and COVID-19, their impacts are undeniably evident, particularly with the sharp rise in outbound transport prices in early 2021. This surge, primarily driven by capacity constraints due to reduced imports, narrowed the gap between absolute inbound and outbound prices. Outbound rates exhibited greater volatility, and during peak periods, the price imbalance shrunk by a surge in outbound prices, reducing the gap by nearly 10 percentage points.

Despite both directions experiencing price declines between Q3 2022 and Q4 2024, we now observe a more stable environment. The rate imbalance has stabilized at 51.6% in Q1 2025, still 7 percentage points above Q4 2020 levels. While COVID-19 had a short-term impact, Brexit appears to have instigated a lasting shift. This enduring change in imbalance is likely due to reduced competition for outbound transports, as UK specialists consolidate operations, leveraging their expertise to navigate administrative complexities. Additionally, local UK carriers, operating on a different cost basis, have bolstered outbound prices.

Four years on, this proportion appears to be the established norm, poised to remain until another external factor disrupts or gradually reshapes the market. However, I expect price increases in both directions. Following two years of declines, industry consolidation, and enhanced efficiency gains, we may witness modest price hikes in 2025.

For those interested in further insights into price imbalances across Europe, we will return after our Easter break with a dedicated article for our paying subscribers on Thursday, April 24th.

Happy Easter !

Christian Dolderer

Lead Research Analyst

Transporeon