European Spot Rates stand strong

Market Monday - Week 26 - road transport spot rates remain high with expectations to maintain elevated levels

In February, I began this analysis, sharing my views and predictions on the development of spot prices compared to contracted price levels. Now, as we conclude the public holiday season and approach summer, it's an ideal time to reflect on how rates have evolved and share my expectations for the upcoming weeks.

For more detailed information on the methodology and data behind the analysis, please refer to the original article.

The following analysis focuses on the overall distribution of spot price levels compared to contracted price levels across all markets we monitor. To ensure meaningful results, we used a truncated mean to disregard outliers.

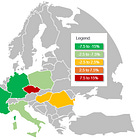

Difference between spot and contracted rates for the past 21 months in Europe

Source: Transporeon Market Insights, own illustration

Each value represents the difference between spot prices and contracted prices within a specific week (Index 100). For instance, in week 21 of 2024, spot prices peaked at 14,1% above contracted price levels.

What is different to 2023?

The main difference from 2023 is the available truck capacity on the market, impacted by slight demand increases in some industries. However, due to overall low demand, reductions in fleet or regional supply imbalances are the primary reasons for the weaker capacity supply.

What can we expect in the coming weeks?

In blue, I’ve projected my expectations on how the spot vs. contract graph could evolve until mid-August. If my expectation holds true, we will see a prolonged period of spot prices exceeding contracted levels. This trend puts additional pressure on the contracted market for prices and rejections, reflecting the changed capacity situation from 2023. The interesting question is: How long will contracted rates remain stable before they start to increase again?

I will keep an eye on this situation and also regularly check the performance of my expectations. Are we likely to see decreasing spot rates, increasing contracted rates, or both? Six weeks ago, I stated that it was challenging to predict. However, given the current changes in the capacity, I now anticipate that we will likely see elevated spot price levels throughout 2024, particularly if the expected demand increase for the second half of the year materializes.

Christian Dolderer

Lead Research Analyst

Great analysis, Christian. Keep up the good work, your information is very useful