European Trucking Capacity: What to Expect After Summer 2025

Market Monday - Week 37 - Rejection and spot offers return to pre-summer levels

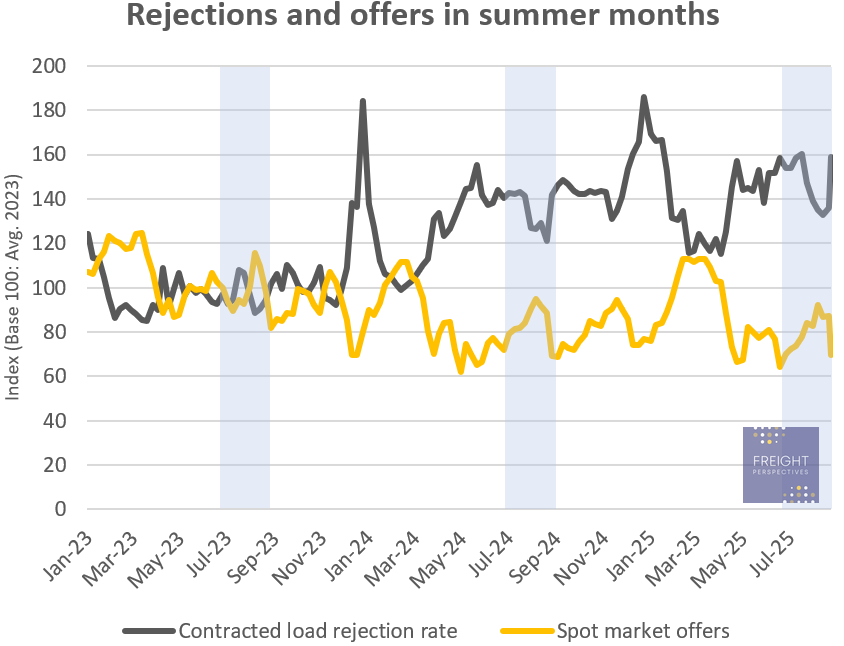

This week on Market Monday, I've revisited our analysis of the seasonal trends for contracted load rejections and spot market offers, our primary indicators for short-term truck availability.

With the beginning of September, we have now entered a time of increased transport demand after most of Europe has concluded the summer holiday period. As drivers return from their holidays as well, it’s time to assess the current situation and its implications for the upcoming months.

After the typical summer slowdown, with rejections facing a significant decline in August 2025, this metric returned to pre-summer holiday level. However, at this level, rejections are now 20 index points above the Sept. 2024 level signaling the trend towards continuously tight capacity and increased market inefficiencies. The surge suggests that even though economic growth is sluggish, overall available capacity remains tense with no signs of relief.

Source: Transporeon Market Insights, own visualization and evaluation

While contracted rejections spiked, spot offers also followed their expected seasonal pattern. With transport demand going down, carriers turned to the spot market to find alternative options, which catered for increased offers per spot load. Also here, offers per spot transport returned to pre-summer levels in the beginning of September. It is now roughly on the same level as in the previous year.

The shift is evident: with increased contracted rejections and spot offers on the same level as last year, the capacity remains tight.

Looking ahead, this continued deterioration to last year’s market situation will show its effects in the next months. We're likely to see a greater focus on the spot market as shippers struggle to secure contracted capacity. This will inevitably put upward pressure on spot rates. Unfortunately for those relying on contracts, rejections are expected to remain elevated. While there might be some temporary softening in November, chances for an even tighter capacity situation during the 2025 Christmas peak are high, as there are currently no signs for supplementary capacity through new registrations. The only imaginable chance for easing the capacity situation is transport demand decrease. Yet, this would trigger additional challenges both sides (shippers and carriers) definitely want to avoid.

In the coming months, we should therefore prepare for more active spot market dynamics and ongoing pressure on contracted prices. The next crucial point for evaluating available capacity, particularly in the lead-up to the Christmas season, will be mid-November.

Thomas Hang

Lead Domain Expert

Trimble Transportation (Transporeon)