From Baltic to Atlantic

Market Monday - Week 31 - Freight Market Developments on the France – Germany – Poland Transport Corridor

When someone wants to talk about key transport corridors in the EU, the first thoughts to appear are probably about the Rhine-Alpine route along the “Golden Banana”, densely populated and connected area approximately in between North and Ligurian seas. But with regards to road transport specifically, I would consider a corridor from the Atlantic coast in France till Baltic coast in Poland equally strategically important, as France, Germany and Poland are some of the key economies in the EU which play an even larger role on the road transport market than their economies suggest.

That’s why today we move East-to-West, trying to understand what the current developments are there and why they are so similar (or not).

The most significant development in recent months has been a sharp increase in spot rates for transports into Germany and France from March to June, driven by tightening capacity. This has exacerbated the long-standing imbalance on the Germany-Poland axis, where strong industrial demand has always pulled freight west. With Poland often supplying both goods and the transport capacity to move them, this recent rate surge further strained the market. We made a good overview of the influencing factors in our recent article:

Adding to those factors, reintroduction of mutual border controls injected significant cost volatility and unpredictability into the market. For goods moving through the Germany-Poland border, this meant the presence of the financial and lead-time risk of border delays of up to 60 minutes.

In contrast, the France-Germany corridor reflects a more synchronized economic story. Subdued industrial sentiment has suppressed freight demand growth in both nations. However, this has been counteracted by diminishing capacity, which has consistently pushed prices up even with lower fuel costs.

And capacity is particularly tight in the French domestic market. One of the possible explanations is a decrease in cabotage services from Eastern European and Spanish carriers driving the relative rate increases on domestic and outbound lanes to highs compared to the German or Polish markets.

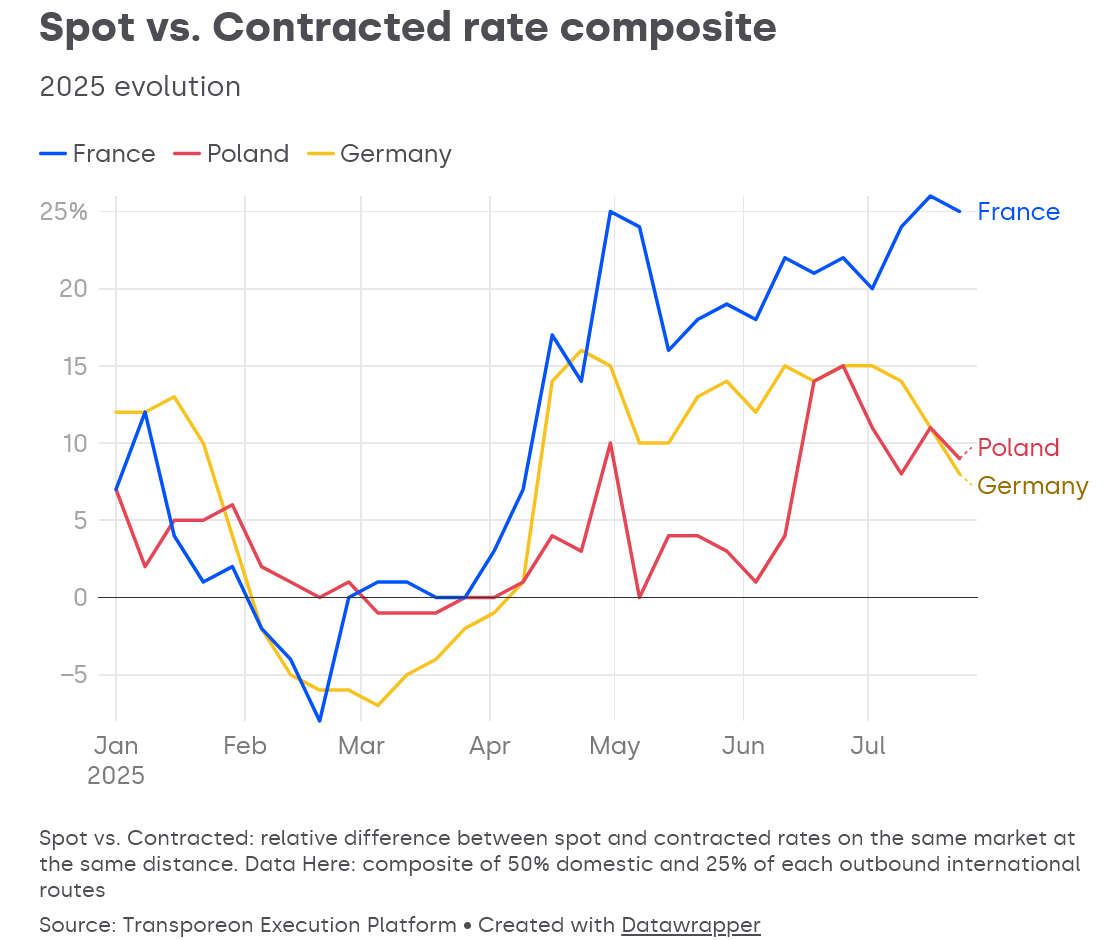

As the chart illustrates, the gap between spot and contract rates in the last few weeks is narrowing, after surging in April-June. Spot rates are stabilizing or trending downwards under the weight of weakening demand. Contracted rates, however, are being pulled in two opposite directions. While lower fuel costs apply downward pressure through fuel floaters, TCO pressures, tight capacity and attractive spot rates have pushed up rejection rates, in turn forcing contract prices upward. This market uncertainty is prompting shippers to blend procurement strategies using contracted transport for baseline volumes and the spot market for flexible capacity.

We expect the typical summer slump in demand to end in August. All across France, Germany, and Poland, the industrial sector is showing signs of a tentative but fragile recovery. So, looking ahead, this anticipated demand increase will collide with ongoing capacity shortages, making the market challenging for both shippers and carriers once again.

While slight, short-term rate easing until mid-to-end of August may occur. Spot prices on these corridors are likely to remain elevated and volatile compared to last year. In this environment, the value of stable, reliable carrier-shipper contract partnerships cannot be overstated, though even they will be tested by the market's volatility.

Oleksandr Kulish

Senior Consultant