Impending Changes: How New Tachograph Rules could Impact European Road Transport

Will the familiar rules of the Mobility Package 1 once again impact the transportation market and cause significant effects? This question, along with the potential implications, warrants further investigation and a deep dive into the possible impacts.

Background

The transportation world changed in August 2020 and February 2022 with the implementation of the EU’s Mobility Packages 1 & 2 - two sets of rules that laid the groundwork for changes in the road transport sector. Significant impacts on the structure of the transportation market were expected, especially with regards to available transport capacity and the use of cabotage (the right to operate and transport goods between two places in the same country).

Source: VDO

Now, 4 years later, one segment of the introduced rules could impact the transport sector again. By 31 December 2024, all existing vehicles over 3.5 tonnes without an intelligent tachograph in cross-border traffic must be retrofitted with the new intelligent tachograph of the second version. From August 2025 onward, this retrofit also applies to trucks with an intelligent tachograph of the first version.

For more detailed information please visit:

Potential effects on the market

What initially seems like a routine garage visit could significantly impact European road transportation. First, there is the time needed to change the device - a solid assumption is around 2 hours for changing it. Second, there is the total downtime of the truck, meaning the time it is not active within its usual productive network. Pulling the truck out of this network will add further downtime; expect half a day up to a full day for the change. The complexity of fleet networks, combined with limited garage capacities, could cause further disturbances if a smooth change with minimal downtime isn't achieved.

Source: VDO

Maybe I’m too pessimistic and might sound like a doomsayer, but I expect that if around 1 to 1,5 million commercial vehicles need this upgrade and fines e.g. up to 25.000€ (along the North Sea - Mediterranean - Corridor) are for non-compliance, there is a severe risk that too many trucks will seek this change at the “last minute” during November and December. More operational downtimes and disturbances are a logical consequence.

To provide context to my concern VDO, a brand of Continental Automotive and Europe's largest tachograph manufacturer, estimates that as of yesterday (July 24th), only around 25% of the affected vehicles have received the tachograph upgrade. This seems too low given the garage capacities and the 5 months remaining to complete the upgrades. According to Continental`s Michael Gut, the supply chain has sufficient stock of the required tachographs, addressing rumors of a shortage.

“The manufacturers, and especially we at Continental are able to deliver and can supply the workshop network with sufficient devices for retrofitting.”

Michael Gut, Program Manager Tachograph Workshop Services

Consequently, we need to anticipate the possibility that not all trucks will receive the new device in time. Thus, a reduction in available capacity, especially for international operations during the first weeks and months of 2025, should be expected. This also applies to domestic transports with a considerable share of cabotage operations. The more hauliers from a foreign country are in constant use, the higher the risk of supply shortages during this period. Due to the DSRC-RP-Modul and the new remote-scanning-technology, trucks without the required tachograph can be easily identified during a drive-by, making non-compliance easily detectable.

Another aspect to consider is that older trucks, nearing the end of their lifespan, might be deregistered or removed from international business. In my view we cannot ignore the possibility that not all these deregistrations or new business assignments will be compensated with new trucks entering the market, especially when factoring in the driver shortage and the financial situation of the hauliers.

What to expect for the end of 2024 & the start of 2025?

Market dynamics, particularly the demand and supply situation, are heating up. I expect this trend to continue. The most likely scenario will be higher-than-usual rejections and a greater need for backup carrier utilization on the contracted side, leading to increasing spot shipments and higher than usual prices. A mitigating factor will be the seasonality at the beginning of 2025, as January and February usually see lower transportation demand. This should ease spot price levels and reduce the risk of supply failures.

As trucks with first-version intelligent tachographs will also need to change the device until August 21st, this legislative measure of the mobility package will impact almost the entire year of 2025. While the impact will likely be less significant than in December, January and February, a potential overall de-registration effect could impact the whole year.

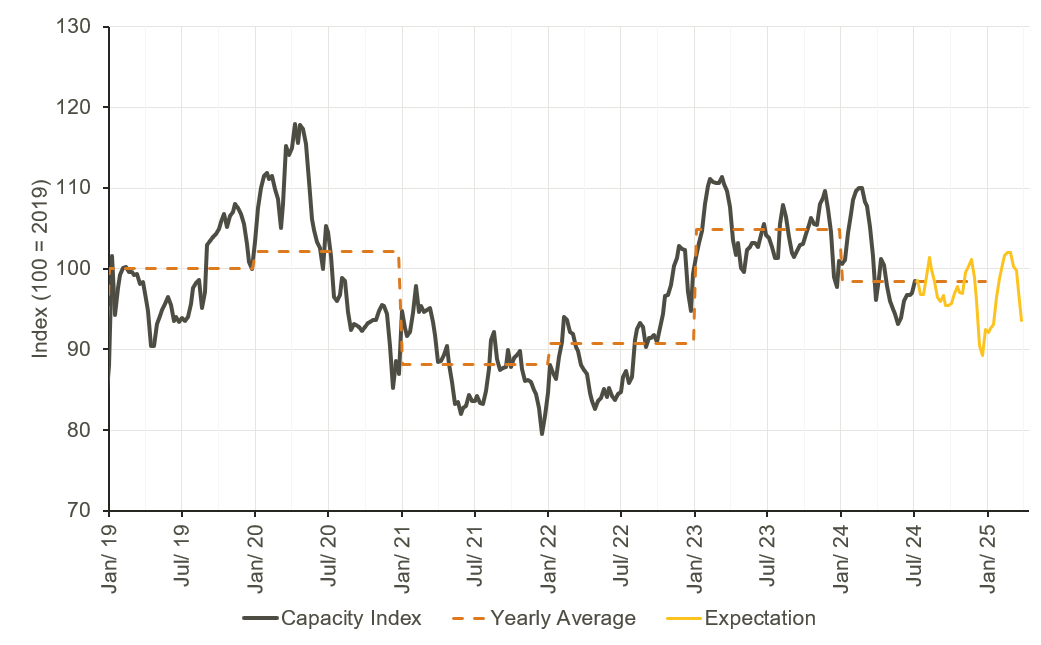

The following chart shows my current expectation regarding capacity development until the end of 2024 and the first quarter of 2025. These estimates do not yet account for the negative impact described above. I still hope that the majority of trucks will receive their new devices by the end of the year to prevent the capacity index expectation from further downward corrections.

European Truck Capacity Index

Source: Transporeon Insights, own evaluation & expectation

Our advice for all involved parties

As market dynamics heat up, early planning of the necessary device change will ensure a smooth transition. Both hauliers/carriers, and also shippers should actively address this issue to prevent an overheating market situation. The anticipated disturbances and inefficiencies won't benefit any of the involved parties at the end.

Many thanks to VDO for providing detailed information about the current state of the upgrade, the total addressable market and the overall background.

Christian Dolderer

Lead Research Analyst