Polish Border Controls Revisited: Initial Spike Subsides, Logistics Impact Now Limited

Market Monday - Week 44 - Update of stationary border controls impact in Poland

Poland’s reinstatement of stationary border controls with EU countries from 7 July 2025 onwards was expected to create significant challenges for European logistics operations. These controls were an answer to earlier measures from Germany and were expected to directly impact supply chain timelines and increase operational costs.

Today’s post revisits this topic and provides data and insights on how this governmental measure continues to affect transport and logistics operations. A few days after the measure's implementation, the initial analysis confirmed a significant impact, with delays of 90 minutes instead of the usual 10 to 20 minutes on Fridays. You can find it here:

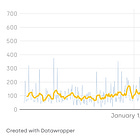

Three months later, the data shows a significant uptick in average border waiting times in July, confirming an exceptional situation during this month. However, during August, waiting times began to decline and concluded at significantly lower levels, while September averages remained elevated compared to 2024, but not much higher when measured against the first half of 2025, which we assume to be an organic level of border friction.

So, while officially the measures are still in place and were recently prolonged until April 2026 on the condition that Germany continues its policy and does not stop its own incoming controls, it is visible that the real-world impact of Polish measures in September and October so far was limited, if not inexistent. This is good news, as the Polish government stopped hurting Polish carriers to make a political statement towards Germany. The most recent daily data also lets us hope that this will continue, and the future impact on the logistics industry will be limited.

Luckily, I was wrong and my fears after the first days after the implementation turned out to be those of a doomsayer, as these checks did not escalate to potentially harsh consequences such as reduced service provisions from Eastern European fleet owners to Western Europe, causing higher spot rates.

Christian Dolderer

Lead Research Analyst

Trimble Transportation (Transporeon)

Very good to hear that impact is very low and pessimistic analytics were wrong.

It's a shame that information and similar analyses regarding the impact on the supply chain of the controls Germany introduced in 2023 with all its neighbours, which remain in effect to this day, are nowhere to be found. Specifying Poland while omitting information about other countries and regions exemplifies a biased approach to the issue and a politically motivated effort to denigrate a given country's sovereign decisions.