Sport Event with Limited Impact on Spot Rates in France

Market Monday - Week 32 - Update: Assessing Transport Data in France

The event itself was expected to significantly impact transport operations. Factors such as road closures, overall traffic situation, and increased security levels, all against the backdrop of rising transport demand associated with the event, would likely not just affect the Paris region but the entire country. At least that’s the initial hypothesis we as well as many others had upfront of the event.

Now, after the first week is concluded and many medals have been awarded, it’s a good time to assess what our data and the derived KPIs show.

Background

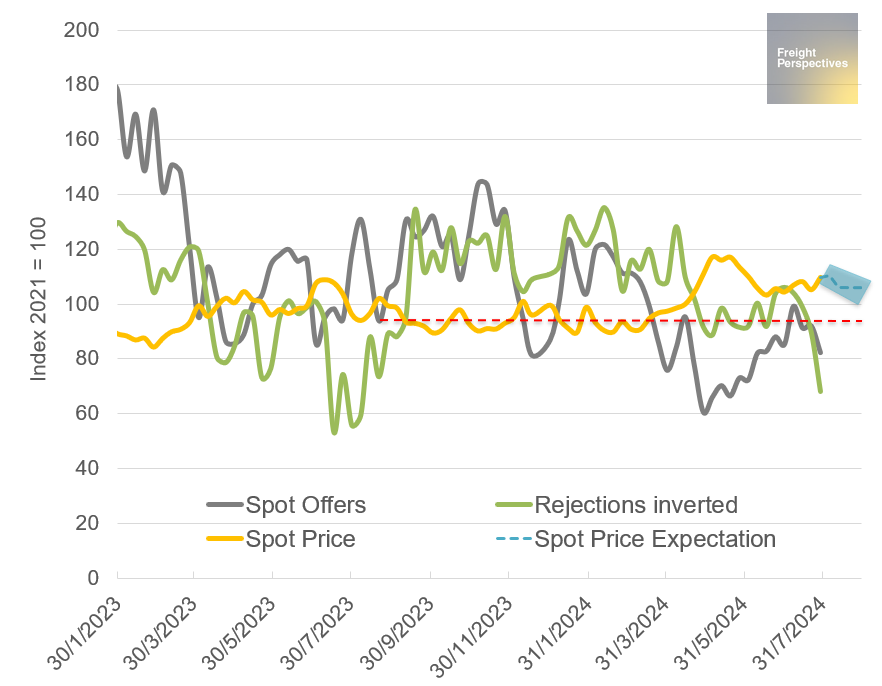

Spot prices are heavily influenced by the market forces of demand and capacity. While demand is expected to slightly increase, the market will likely face reduced capacity and increased inefficiencies. This is presumably reflected in a persistent increase of contracted load rejections (transports that are either timed out or rejected by carriers on the Transporeon platform) and a slight decrease in the number of offers per load on the spot market. The first metric indicates that more loads will be moved to the spot market, not only for the impacted weeks, but also for the preceding and following weeks. The second metric provides insight into market competition, reinforcing the basic theory that more offers lead to lower prices, and fewer offers lead to higher prices.

For better visualization and aligning the contracted load rejections with the offers, rejections are displayed inverted in the graph. Therefore, the decreases in this graph for rejections and offers both indicate an increasing effect on the price.

France domestic road transportation

Source: Transporeon Market Insights, own illustration and evaluation

In May 2024, during the public holiday season, France showed a strong market reaction with significant spot price increases. Offers and rejections followed the expected behavior. This historic assessment is crucial to understand how the market is likely to react and to which level it will likely return to after these sportive weeks. The last two weeks showed no clear price tendency while particularly rejections but also offers fall short.

Are we seeing a clear and direct impact of the major sport event in these movements?

I again must answer with NO.

Although initial signs, such as smaller price increases and significant decreases of influencing factors, are visible and could be caused by the event, these changes could still be seen as usual seasonal spot market behavior and fluctuations. Previous summers without such major sport events showed a similar behavior in prices as well as rejections and offers. What we can confirm now, seven days after the start of the event, none of the prior described potential effects significantly affected the overall French domestic market.

However, this does not mean that there is no effect at all, particularly the Paris region and transports to and from Paris have been impacted without a doubt.

But these impacts haven’t expanded their effect to the whole country. Fears of overall transportation problems, lack of supply in goods and excessively high transport prices have turned out to be pipe dreams, as the transportation sector in France proved itself as more robust than expected.

The trend within the chart shows my expectation of spot prices movements for the next few weeks. Main assumption is a stabilization after the event and a rather quiet summer vacation period. Mid September will mark the next crucial point for a further assessment on future market trends.

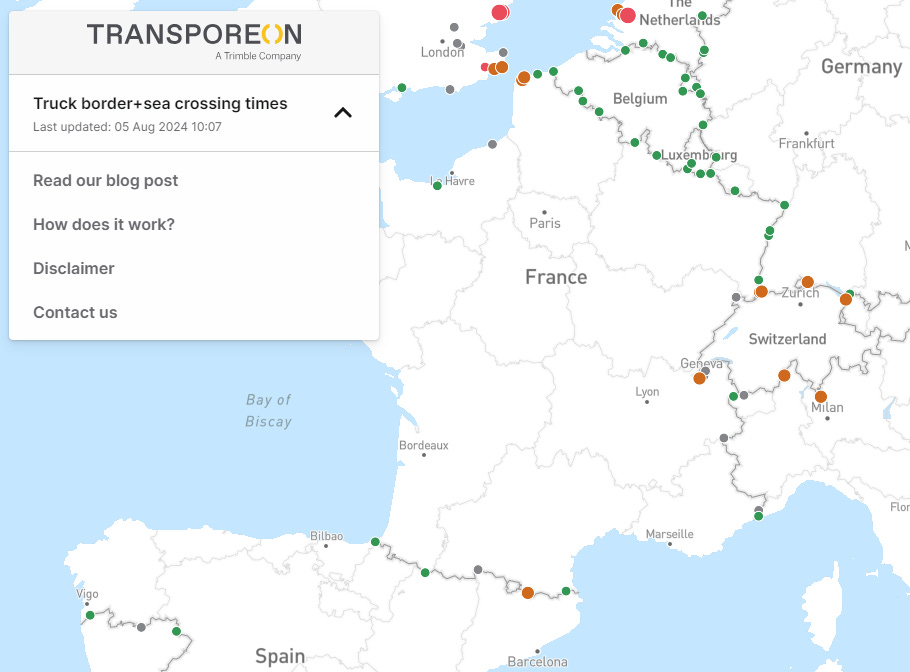

Also at the border checkpoints to France, all remains quiet so far. During the last hours and days, no unusual situation was monitored. Fears that the transport sector will face significant efficiency problems during the event have not materialized.

Border crossing status

Waiting time distribution, daily average from Germany to France

Source: Transporeon Real Time Visibility

The year over year comparison confirms - border controls or increased security levels at the borders had no impact on the transportation market.

Christian Dolderer

Lead Research Analyst