Spot Rates in Europe increase earlier & more significantly than initially expected

Market Monday - Week 13 - seasonal increase in European spot transport rates exceeds expectations

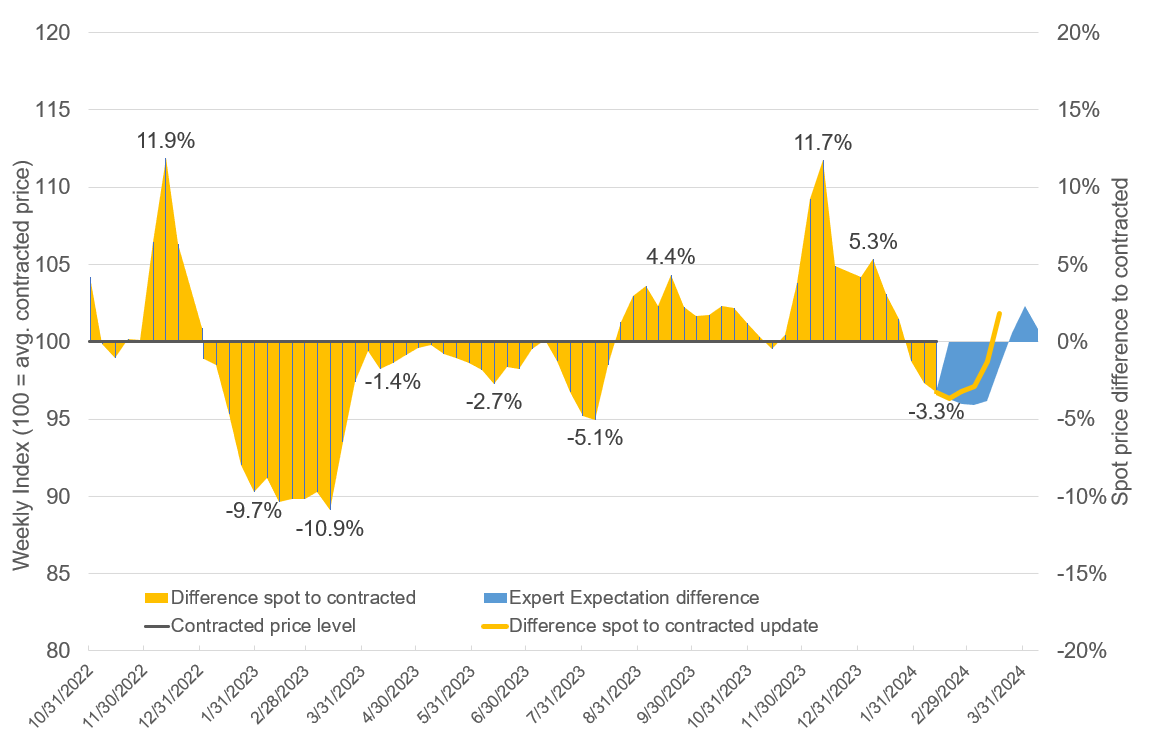

A month ago I shared my predictions about the development of spot prices compared to contracted price levels. Now, with Easter just around the corner, it's a fitting time to reflect on how rates evolved compared to my expectations.

Link to previous post:

While my expectations align with the market's behavior, both the timing and the peak of spot rates have surpassed my prediction. The discrepancies noted in the capacity supply for 2024 compared to 2023, as analyzed in last week's Market Monday episode, are likely the primary factors. It appears that we are currently experiencing either a slightly worsened overall capacity situation, or the demand for transportation has already increased more than anticipated.

General disparity between spot and contracted rates in Europe

Source: Transporeon Market Insights, own illustration and evaluation

What can we expect in the coming weeks?

We are likely to see spot rates to increase further, potentially ending the Easter weeks above expected levels. After Easter, we may see a more balanced situation with a trend towards higher spot rates compared to contracted. This will be subject to fluctuations influenced by numerous bank holidays throughout Europe in April, May and June.

Moreover, we are interested in observing how the demand for transportation evolves. An early and unexpected increase in demand could also be a reason for this spot rate rise as shown.

As Easter break approaches, please note our next analysis and perspective will be available on April 3rd.

Christian Dolderer

Lead Research Analyst