Spot vs. contracted rates, what fits better when and where …

This is one of the top 10 questions I've encountered in my career in Market Intelligence for road transportation and it is not easy to answer. It usually begins with: “it depends on …” and is followed by numerous circumstances, countries and restrictions. However, at Transporeon, we might be able to provide you with more current information based on data related to this topic. This could assist you in making an informed decision or judgment, and shed light on this transport procurement puzzle.

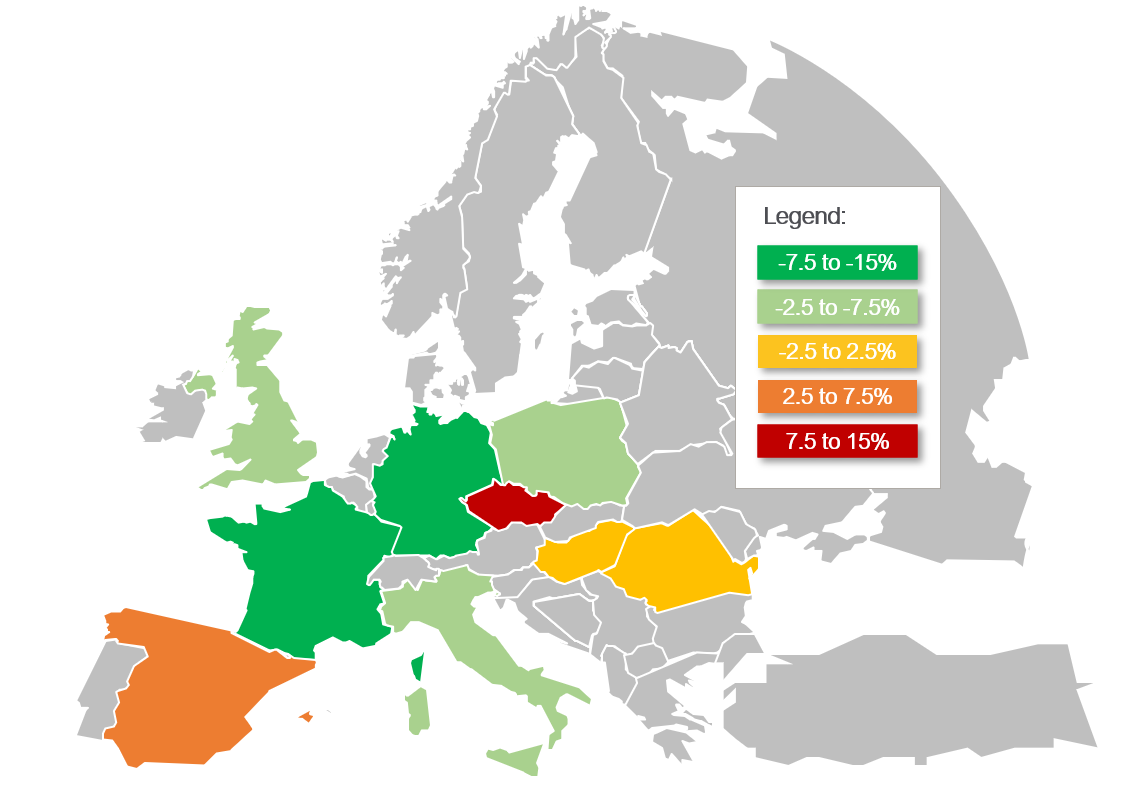

The following map illustrates the countries where domestic transports rates were lower on the spot market (green) vs. the contracted market (red) during week 7 of 2024. To ensure comparability between spot and contracted prices, values are harmonized based on distance.

Spot prices vs. contracted prices for domestic road transportation

Source: Transporeon Market Insights, own illustration

In week 7, spot rates in France and Germany were over 7.5% below the contracted rates, while Czechia and Spain showed higher spot rates.. Apart from Spain, all major European economies were with spot rates below contracted levels.

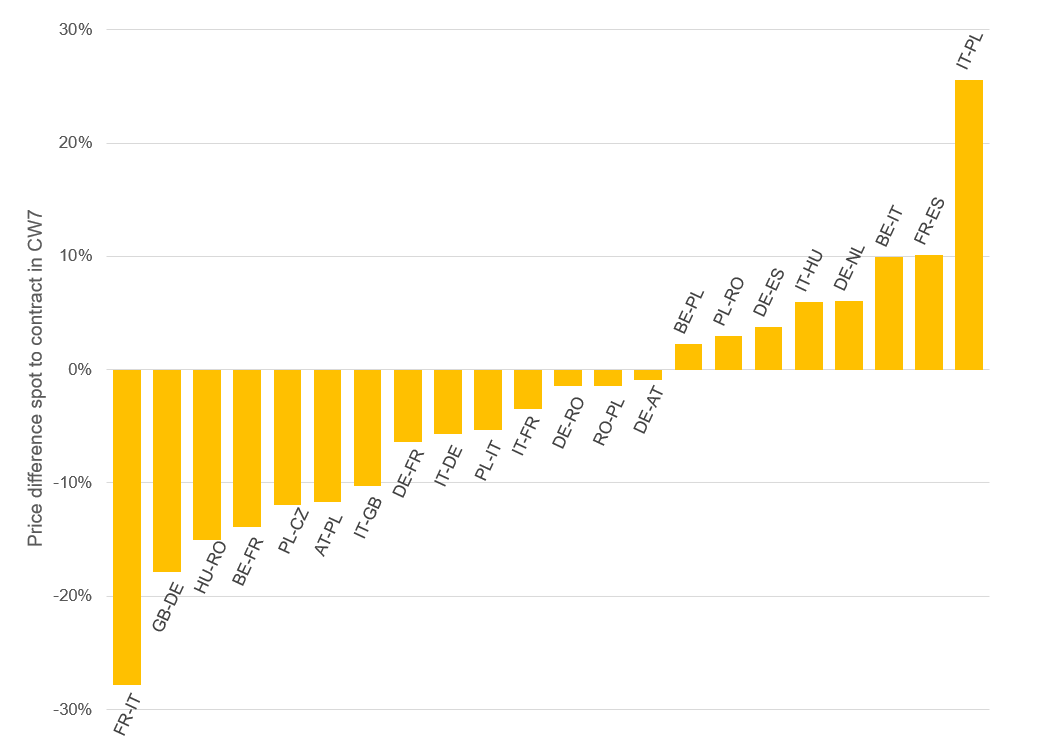

A situation which is also mirrored by international markets. During week 7, 54 country combinations ended up with spot rates below contracted rates, while the opposite was true for 38 combinations. The following chart is a sample from these corridors, reflecting the overall results.

Spot prices vs. contracted prices on selected country combinations

Source: Transporeon Market Insights, own illustration

Single values such as those from France to Italy are extreme and unlikely to last for several weeks, but they very well illustrate the volatile situation on the spot market. On the other side, Italy to Poland shows volatility in the other direction, as price levels on this market are typically more uniform. The trend towards lower spot rates is a common seasonal behavior in the first quarter of a year, where lower demand meets higher available capacity.

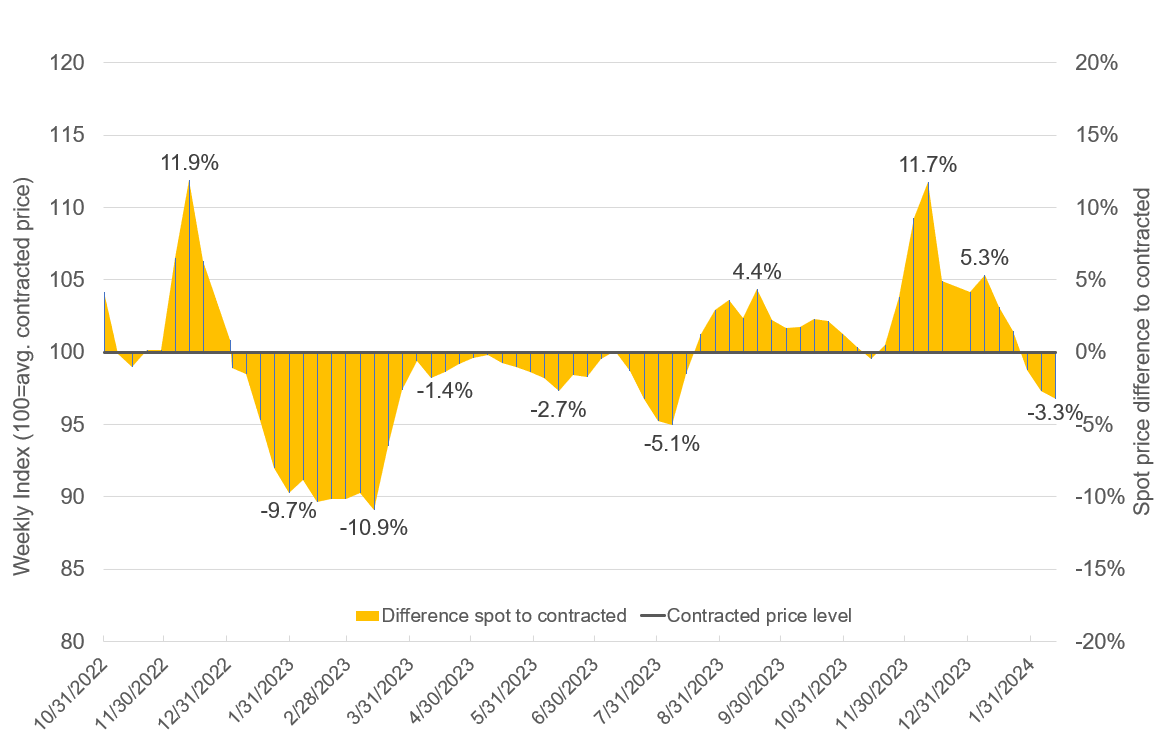

To add strategic implications to this topic, the below analysis focuses on the general distribution of spot price levels compared to contracted price levels across all markets we track. To ensure meaningful results, we used a truncated mean to ignore outliers. The results are displayed in the following chart.

General difference between spot and contracted rates for the past 17 months in Europe

Source: Transporeon Market Insights, own illustration

The past 17 months showed various phases where spot rates were either below or above the contracted rate levels. If we extend this analysis to the beginning of 2021, we would see more instances with spot rates exceeding contracted rate levels due to high demand and limited supply during this time.

Coming back to the graph above, Q1 of 2023 is clearly identified as the period with the lowest spot rates. This trend persists even if we examine data from other years. Hence, during this time of the year, the potential for savings on the spot market is high. Dynamic assignment strategies from shippers and brokers could take advantage of this period if a decision towards strategic spot sourcing is made. But this analysis also confirms that there are times in which less spot business could be financially advantageous.

It's therefore becoming evident that there isn't a simple and direct answer to the initial question, as we cannot identify a clear advantage for either of the assignment possibilities. The best approach, as is often the case, is to dynamically identify the right mix of spot and contracted sourcing based on current market conditions, rather than as a one-time decision. There are countless reasons why this may not be suitable for a specific company, industry or business area. But if we are honest, we need both markets to get things done, so why not professionalize both with tools, processes, and up-to-date information?

This strategy not only benefits shippers, but also carriers. It's sensible for carriers to be well-informed about current market conditions and to understand which area, market or line of business offers the best opportunities.

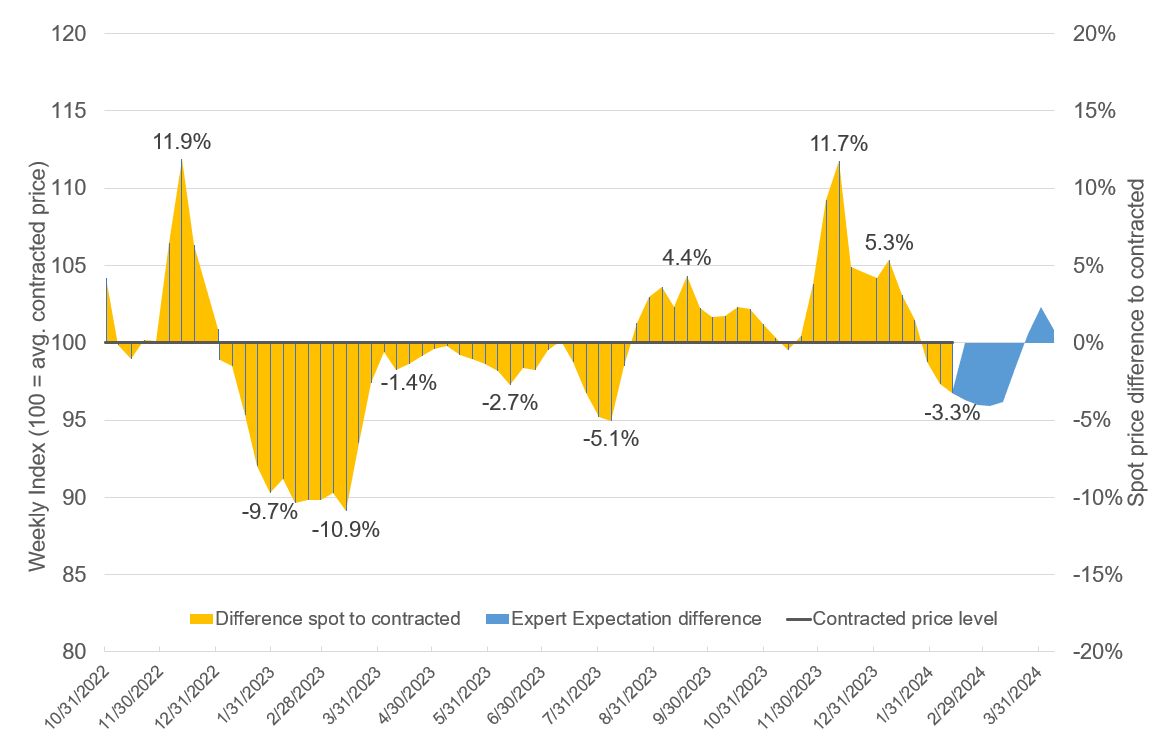

Anticipating one of the next questions, I'm happy to share my perspective and expectations on how the spot vs. contract graph could evolve in the coming weeks.

Source: Transporeon Market Insights, own illustration and evaluation

We are likely to see an overall advantage on the spot market for the next 3-4 weeks. However the closer we get to Easter, the higher the probability of increasing spot price levels needs to be considered. After Easter, we may experience a balanced situation - with a tendency towards slightly higher spot rates compared to contracted - with ups and downs influenced by numerous bank holidays throughout Europe in the weeks of April, May and June.

Christian Dolderer

Lead Research Analyst

Transporeon Market Intelligence