The European Rail & Intermodal Freight Market in Light of the DB Schenker Sale

While the Green Deal aims for European rail volumes to double by 2050, the reality is quite different. With increasing economic uncertainties and the deindustrialization of Europe the perspectives for what is called modal shift are not positive. How does DB´s sale of Schenker fit into this picture, and is the German Minister of Transport right?

A wide range of academic and other research underpins rail and intermodal freight are more sustainable compared to most other transport modes, road freight in particular. The sheer efficiency of mass transport based on iron-on-iron sliding outperforms any rubber-on-asphalt movements of a moderate amount of goods per unit. In that context it's not surprising that many industry representatives talk about modal shift.

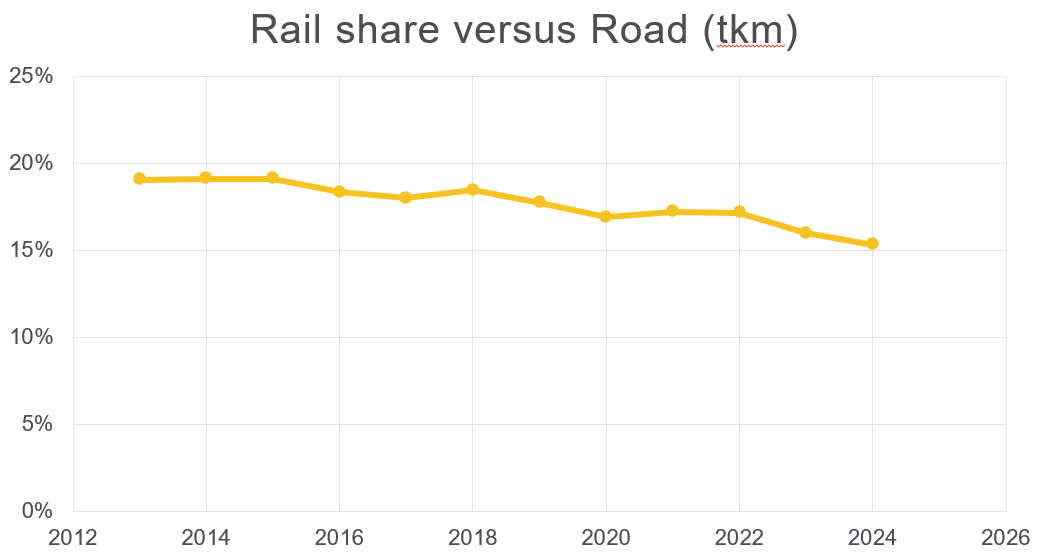

However, there's a gap between talking and action. Despite all the chatter that everybody calls for modal shift, the numbers tell a different story. No-one is doing it. Almost no-one. As the pure figures show there is no such modal shift towards more sustainable rail or intermodal freight, actually the modal shift is moving in the opposite direction.

European Rail Freight Trend

Source: Eurostat, BCG, IRU – 2023 + 2024 are estimates

In recent years, conventional rail transport has been losing ground, both in market share and actual volumes. Intermodal transport on the contrary has seen some growth in volume, but it's still not winning against road transport. The last two years have been particularly tough, with intermodal transport losing almost 20% of its ton-kilometer performance due to lower demand, higher energy prices, and reliability issues. Since Q2 of 2024 this downward trend seemed to stop. However, recent two-digit percent increases of railway track charges, including those which have been announced to come, will reduce the competitiveness, compared to rail and intermodal.

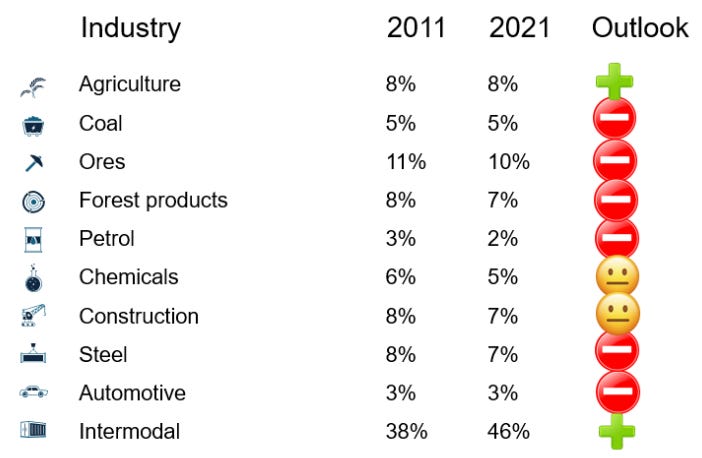

Looking ahead, from those industries which contribute to rail freight the most, only agriculture has a positive volume forecast. Hence any hope for growth in rail freight lies with intermodal transport, which is set to make up 50% of all freight soon.

Rail Share by Industry

Source: Eurostat, Boston Consulting Group

Most other mega trends, which impact commercial rail transport, aren't helping rail and intermodal freight either. Rotten infrastructure, continued deindustrialization, unhelpful policy directives are all working against it. The only silver lining? A shortage of truck-drivers has the potential to overcompensate these trends.

Mega Trends for Rail

Source: Transporeon

In this scary situation Deutsche Bahn (DB) sold it´s logistic service provider (LSP) Schenker. Schenker had been a subsidiary of DB for almost 17 years, originally bought to help DB capture more international shipping business. Analysts had found that their 200 tier-1 customers shipped 60% of their products abroad and Schenker should help DB to grab a good portion of those volumes.

Over the years, Schenker became a reliable source of profit for DB, which was often struggling financially. Despite some national pride being hurt, this sale could actually benefit Schenker. The new owner has a strong track record in managing successful logistics businesses.

Meanwhile, German Minister of Transport, Volker Wissing, suggested that selling Schenker would help DB to focus on its core business, German domestic rail transport in particular.

While we cannot claim that Mr. Wissing had been involved in the questionable acquisition of Schenker, the lack of investments in (rail) infrastructure under CDU led governments over the past decades or DB´s commercial and financial crisis, we may still ask ourselves who had written that statement, which demonstrates a total lack of rail freight understanding?

Though rail transport isn´t limited to long-distance transport, the entire industry agrees that the longer the distance the more competitive rail and intermodal transport becomes. For intermodal transport to be successful, the rule of thumb suggests that it requires 300 kms of distance to operate a commercially successful rail freight corridor. Domestic transport is fine but indeed not the better side of the medal.

Has DB ever focused on Schenker or has Schenker ever absorbed management or any other valuable resources, which rail freight has missed then? In short the answer is a clear NO.

Is the future of rail in conventional freight? As we´ve seen, if rail wants to be successful it needs to favour intermodal transport as the only growing segment. While DB hasn't made any serious steps towards a proprietary intermodal offering, Schenker as LSP could have helped them to accelerate intermodal development. But you can't speed up something that doesn't exist in the first place.

What Does This All Mean?

The future of European rail and intermodal transport remains challenging. The current direction it takes is not what the European Commission expressed to aim at. And it isn’t in line with what the shippers claim to do.

Given all these trends and what's happening in the industry, the future of European rail has to be intermodal. Otherwise, it doesn't have much (good) future at all. All actors in the sector and in the end-to-end supply chain need to incorporate this into their tactical and strategic plans.

The view expressed by the German Minister of Transport is more than questionable and we can only hope it doesn't represent concrete policy plans or a corporate strategy.

Author:

Serge Schamschula, Transporeon, Head of Ecosystem,

ALICE Vice Chair in “Global Supply Network Coordination and Collaboration”,

Director at the European Freight and Logistics Leaders Forum