The Freight Rate Puzzle: Understanding the Influencing Factors

…and why the cheapest rate is not always the best rate

Our recent reports focused on the changes in rate levels and what we can expect in the near future. In this article, we take a moment to consider this issue more broadly. A big problem with freight rate levels is the multitude of influencing factors, making it almost impossible to pinpoint one specific factor impacting rate evolution. (Unless there would be a significant event like an immediate fuel tax increase by the EU Commission, but that would be a different story).

Therefore it is important to understand these factors and their correlation, which constitutes the freight rate puzzle. If you have ever wondered why the cost of freight transport from Amsterdam to Paris differs from the cost from Paris to Amsterdam, this article will help you solve it.

Breaking down the influencing factors

When I refer to rates, I am predominantly speaking about the contracted freight rate the shipper pays to the carrier. This rate is usually determined by a tender process followed by negotiation and is set in a contract between shipper and carrier for a specific period.

Both stakeholders have a direct impact on the rate level, but there are also external impacts such as macroeconomic changes or legal regulations. So, in general, there are three forces that influence the rate level: the shipper, the carrier and the external environment.

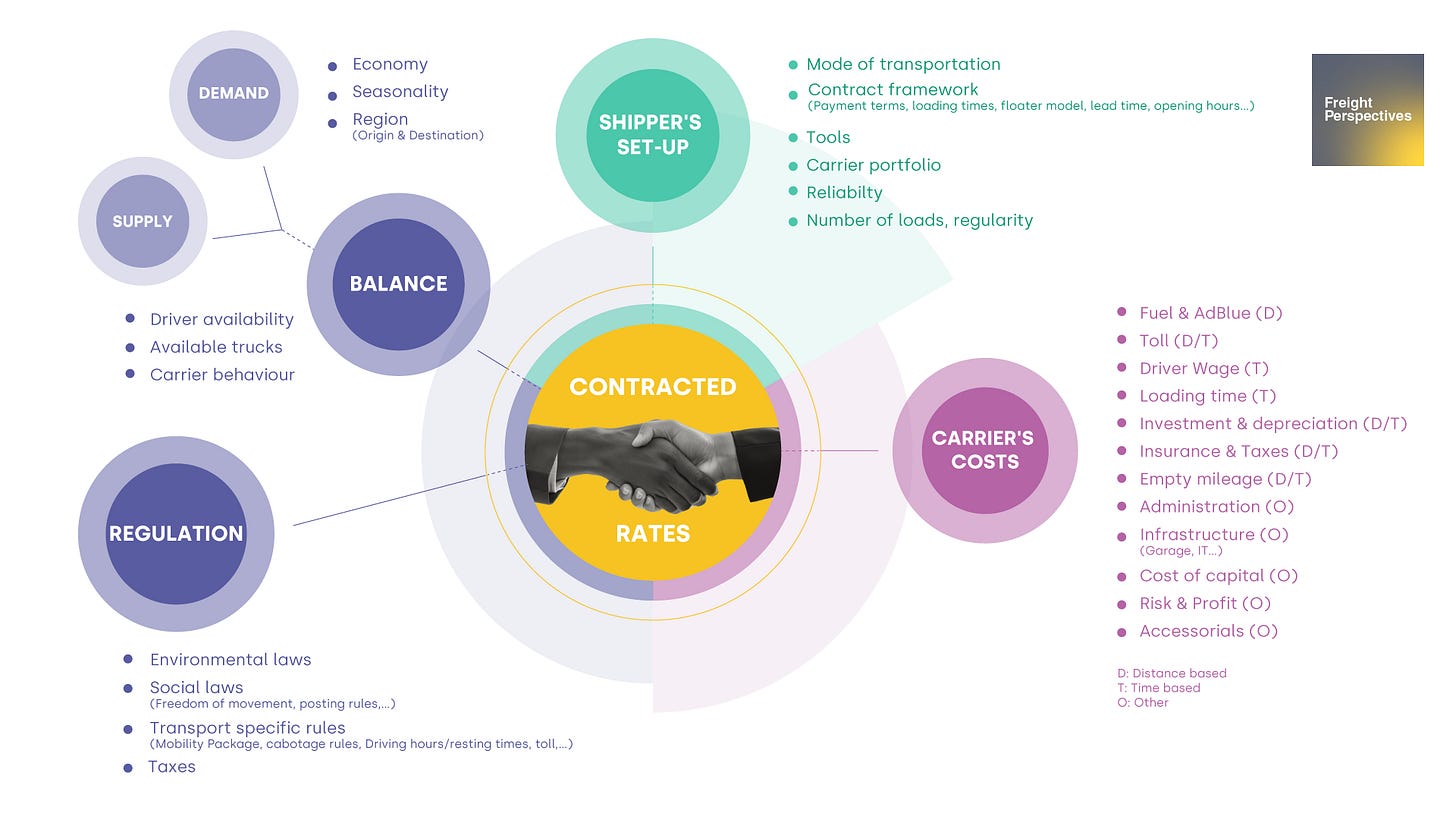

The influencing factors are illustrated in the following chart:

Source: Own illustration

Carrier cost structure

The transport rate is largely determined by the distance and time taken for a journey. The carrier has to manage several costs to cover it. Some of these costs are under the carriers’s control, while others, like fuel prices or road tolls, are set externally. These factors alone already make up about 40-50 % of the overall transport rate. Yet, most other cost factors can be influenced by the carrier.

The most important time-dependent factor is the driver's wage. In the past, wages were used as a measure to reduce transport prices because there were plenty of drivers available. Today, in times of driver shortage and additional regulation, the driver wages are steadily increasing.

Other costs solely related to time include the loading time required by the shipper. Additionally, there are also costs related to both time and distance. These include equipment depreciation, insurances & taxes, and also the cost of empty mileage.

Lastly, there are also costs that are not directly related to the transport, but are necessary to keep the business running. These include administrative costs, infrastructure costs such as buildings, IT, garages and capital costs. The carriers also need to consider risk and their own profit. Special services, like handling of dangerous or high-value goods, providing of unloading equipment, storage or timely delivery and many more also add to the cost.

The carrier calculates all these costs, whether controllable or not, to determine a price that covers the costs and is acceptable to offer to the shipper.

Shipper set-up

Some shippers might now be surprised, but also shippers play a crucial role in determining freight rates due to their particular set-up and interactions with carriers. Their choices can impact all stakeholders, sometimes leading to higher freight rates even when the shipper is saving costs elsewhere. Key factors that influence rates include the terms of the contract stipulated by the shipper, such as the hours of free loading time, payment terms, floater models, notification period before loading a transport or penalty clauses.

Strategic choices also affect rates. For instance, a shipper may choose to work with fewer carriers to reduce administrative tasks, but this might limit access to lower transport rates, thereby increasing their overall transportation budget.

The shipper specifies transportation mode, which can range from diesel engine to electric vehicles, and the type of trailer used. (Standard, Mega, Jumbo, Road train, Reefer, etc)

The tools used by the shipper for e.g. transport ordering or during the procurement process, can streamline processes and potentially lead to rate reductions.

Additionally, creating attractive routes with a reliable frequency and sustainable volumes can help in securing rate advantages given by carriers.

Understanding demand & supply dynamics

The elements we discussed earlier mainly dictate the cost of transport. Yet, like all goods and services, transportation rates also depend on the principles of demand and supply.

When demand aligns well with capacity, the transport price largely reflects the carrier’s costs, with some influence from the shipper’s requirements.

If capacity runs short compared to demand or if a capacity shortage is anticipated, carriers have the upper hand in negotiations and might be able to increase prices.

On the other hand, if there is a surplus of trucks and not enough demand, carriers may reduce their rates to secure business. However, in the context of Europe’s notoriously low-margin transport industry, there's limited room for such reductions.

The reason for these low margins is that the supply of road transportation capacity is based on a huge number of carriers, who have free market access (see regulation). This builds up competition between carriers and reduces dependencies. The importance of supply and demand on rate levels is therefore lower compared to the ocean freight industry, where the balance between supply and demand dictates the price on a larger scale.

So, what factors affect supply and demand in road transportation?

Several factors can influence the demand for transportation. A key factor is the overall economic situation. Important indexes, which reflect the current economic situation, comprise interest and inflation rates, GDP growth rates, and managers’ expectations for economic growth.

Simply put: The better the state of the (producing) economy, the higher the need for transportation.

Seasonal changes throughout the year also affect demand. For example, demand may change due to the recovery in spring, summer holidays, the Christmas rush, and slower winter periods. These changes vary from country to country.

Depending on the industry, there might also be an impact on the transport demand as the automotive industry may have lower transport demand when factories close for the summer, or there may be a higher need for food transports originating in Southern Europe during winter time.

The location of the transport's origin and destination also plays a significant role. If the starting point or destination is in a rural (rather low demand), or urban area (rather high demand), it changes the availability of connection loads. So, if carriers can find a direct connection load, they can offer a rate that reflects the direct cost of that transport, if not, the carriers need to charge more due to empty mileage.

Despite the ever changing demand, the supply of transportation capacity remains rather stable. This stability is due to the long investment cycles, driven by carriers’ long-term economic expectation. They will invest into new trucks and trailers when they foresee future profit opportunities. However, they also have to contend with driver shortage, which has become one of the biggest bottlenecks in the recent past. This shortage exacerbates truck availability issues, leading to multiple problems, the most prominent of which is the mismatch between demand and supply.

Besides, the carriers’ tactical decisions also impact rate levels. For instance, during periods of capacity shortage (e.g. 2017/2018, After Covid whiplash in 2021) many carriers allocated a higher share of their trucks to the spot market, which promised higher margins at that time. This caused panic among shippers and eventually led to higher contract rates.

On the flip side, during times of excess capacity, shippers often pit carriers against each other in pursuit of the cheapest available rate.

Regulation

Lastly, legal regulations affect the European transportation industry. Due to its border crossing and location independent nature, the transportation industry has specified rules and laws. First and foremost rules like Mobility Package, cabotage and driving hours limitation provide a legal framework for all industry players. Though these rules aim to ensure fair competition and increased safety, they come at a cost that carriers need to incorporate into their offered rates.

In addition, social laws like freedom of movement enabled many Eastern European carriers to enter the transport market, significantly impacting rate levels. Posting rules aim to prevent wage dumping and ensure that competition doesn’t exploit drivers.

In the future, the need to address climate change may lead to new rules to fulfill carbon reduction goals. These measures comprise the carbon emission trading system (ETS), registration limitations on carbon combusting trucks, additional taxes or reduced tolls for electric vehicles for example.

Final remarks

To illustrate, let's revisit the Amsterdam to Paris example. The rates differ between these two routes due to the trade imbalance between the Netherlands and France. The higher transportation demand from the Netherlands to France, coupled with carriers’ need to return empty due to the lack of back- or connection load opportunities, results in higher rates. In contrast, shippers based in Paris can benefit, as carriers are willing to offer low rates, in order to cover at least some part of their return cost to the Netherlands.

As evident, various factors influence freight rates. However, the rate level shouldn't be the primary focus. A bigger advantage comes along with establishing a respectful and trustworthy relationship between the shipper and carrier. This relationship should be a balanced exchange benefiting both parties.

In the past, shippers overly focused on short-term gains suffered in times of capacity shortage when carriers turned their back on them. These shippers learned the hard way that cheap transports often come with hidden costs. Nowadays, shippers are placing more value on good relationships with the carriers. These collaboration approaches are crucial, especially in the face of prevailing driver shortages and inevitable climate change transformation, that will pose additional challenges in the future.

However, it remains to be seen how long shippers will remember and maintain this approach and act accordingly.

Thomas Hang

Lead Domain Expert