The Pricey Patchwork: Unpacking Europe's Most Expensive Freight Corridors

Market Monday - Week 36

After the summer break, many of us return to work. To ease the transition, let's take a fresh look at the European transport market. When working with the massive Transporeon data set, I regularly come across one or the other interesting fact worth mentioning to our Freight Perspective audience.

This week’s episode will therefore highlight the most expensive corridors on the European transportation network. Caution: The results may challenge common assumptions.

The European transportation sector is a patchwork of different member states and their unique characteristics. The market's opening to third-country providers, particularly from Eastern Europe, made it even more complex to keep track of the many factors influencing transport prices. These include demand, supply, connection load opportunities, and regulatory obligations, as well as natural factors like a driver returning home after weeks on the road, a common practice for many Eastern European drivers.

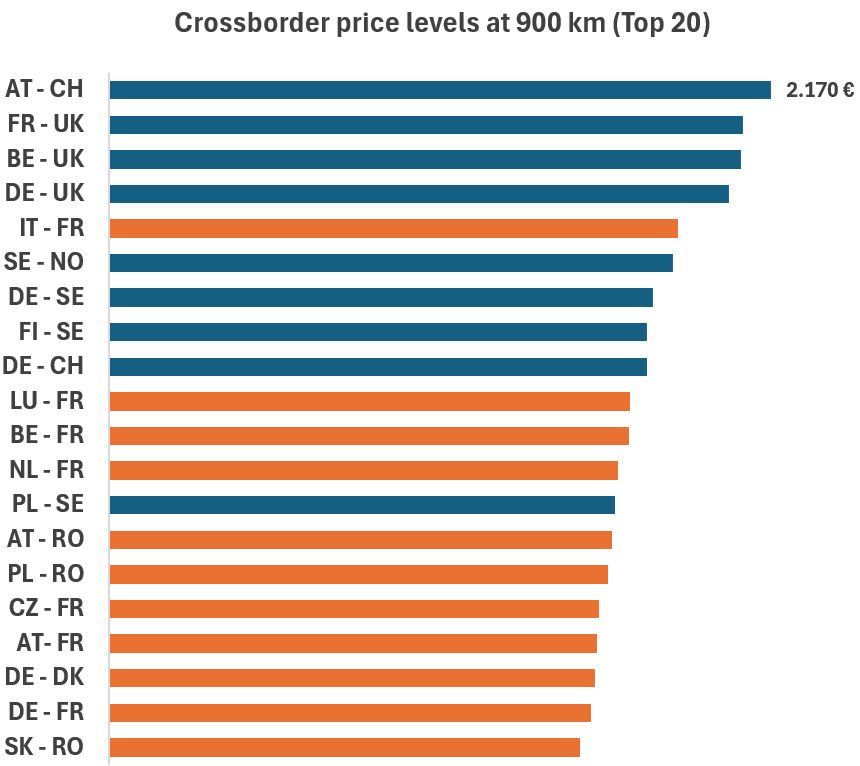

All these elements drive prices on a specific corridor. In this article, we'll identify the corridors with the highest price levels relative to distance. Our methodology is straightforward: we set a fixed distance and analyze the country corridor with the highest contracted transport price at that distance. We've analyzed the average prices for all available corridors in Market Insights using data from July 2025. This is important because if you were asked for the most expensive corridor in Europe, you might plausibly reply “Portugal to Finland” due to the immense distance. However, our focus here is on relative price, not absolute. We've fixed the distance at a representative 900 km and posed the question: What is the most expensive European cross-border corridor at this distance?

Cross-border Transport Corridors

Given the expertise of our audience, you'd likely predict inbound corridors to the United Kingdom, Nordics, and Switzerland. This assumption is correct. As the chart below shows, these corridors dominate the top ranking (marked in blue). The main reason for this is the huge imbalance between imports and exports in these countries. Carriers must charge a high price on these routes to at least cover some of their empty mileage on the return trip (UK, Nordics). Additionally, administrative efforts and the high cost of living in countries like Norway and Switzerland also elevate prices.

Source: Transporeon Market Insights

The only corridor that rivals these price levels is Italy to France (IT-FR). The significant trade imbalance and additional costs for crossing the Alps (toll and tunnel fees) raise transport prices to a level equaled only by the aforementioned corridors. A closer look at the data reveals a structural peculiarity with France: seven of the Top 20 corridors have France as a destination. Due to its trade deficit with other European countries, transport prices for inbound flows to France are widely elevated.

Another destination country, which is represented several times in the Top 20, and also somewhat surprising to me is: Romania. Due to its remote location, transporting goods to Romania is not appealing to the majority of carriers (except for Romanians). The trade deficit towards the rest of the EU reflects a low origin demand not only in Romania, but also in adjacent countries, offering little incentive to take on transports to Romania.

Domestic Transport Corridors

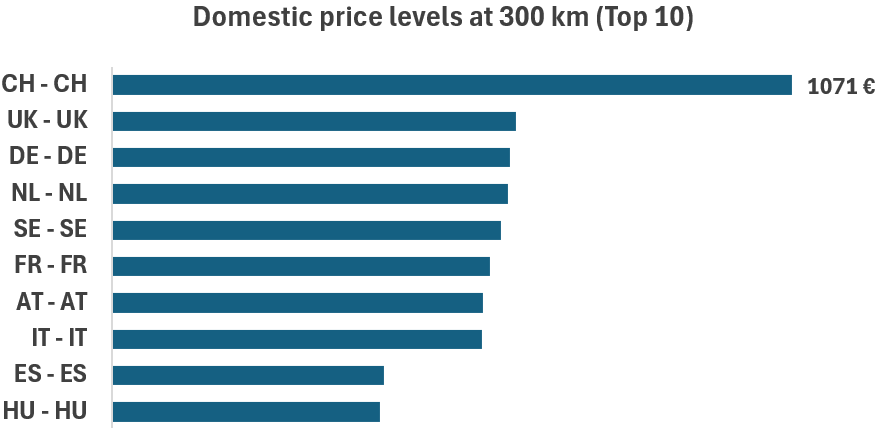

For the comparison of domestic transportation, the question is: What is the most expensive European domestic country at 300 km?

Source: Transporeon Market Insights

The leading countries are those with high underlying costs. Local fuel prices, road tolls and wages are the largest differentiators there. By a large margin, Switzerland is the most expensive, surpassing other Western European countries like the UK, Germany, or the Netherlands. Hungary is the only Eastern European country represented in this group, with other Eastern nations following behind.

However, it's important to note that this is only an average view. Within a single country, trade flows can be imbalanced, which can distort the average result. Regions like Southern Italy, Northern France, Eastern Germany, and Northern Great Britain have very different demand situations compared to their country averages. Therefore, to capture the specifics of a particular region, it's crucial to analyze data at a more granular level.

How did you do?

Did you foresee inbound prices to the UK, Nordics, and Switzerland? Have you also predicted France and Romania as followers? Then you're truly an expert!

Knowing the most expensive corridors is a great starting point, but understanding the drivers behind these results - such as general cost levels, and the demand and capacity situation - is even more important. Only then can you accurately assess the impacts of specific market changes.

Tools like Market Insights are designed to help you identify these drivers and better shape your market approach. In a major relaunch this September, we will enlarge our scope of available market prices by 150 corridors, both domestic and cross-border, giving you a Europe-wide overview of market price levels and how they relate to your particular network.

If you are interested in learning more, please use following link::

Thomas Hang

Lead Domain Expert

Trimble Transportation (Transporeon)