The real cost of Germany’s toll increase

A road transport market update

In the heart of Europe lies a nation renowned for its precision engineering, efficiency, and meticulously crafted autobahns - Germany. Yet amidst the interconnected web of European transportation networks, a recent development in Germany has sparked discussions within the European road transportation. The decision to increase tolls on German roads for commercial vehicles represents more than a mere adjustment in fees; it signifies a pivotal shift that has substantial ramifications for the logistics, trade, and economic landscape. Let's begin by examining the current market conditions because they significantly influence the potential implications of a toll increase. Understanding these conditions is crucial to anticipate the impact of any changes in toll rates.

Market observations

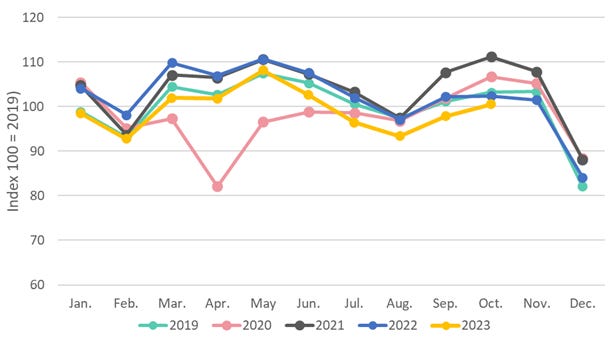

European road transport market is feeling the effects of a slowing economy: demand is falling, dragging down rates, investments, and optimism in the sector. October saw a 1.8% decline in demand compared to the same time last year, the start of the economic downturn. This slight negative movement is also responsible for a generalized surplus capacity.

November demand will be known in the next two weeks and the December metric in early 2024. The trend will set expectations for the new year’s first quarter. In the October 2023 period, the construction and chemical market verticals experienced the most significant declines, year over year at 11% and 9% respectively, followed by the automotive and paper industries.

First quarters traditionally experience lower demand. However, the looming question stands: Will this historical trend persist into 2024?

Transport demand in Europe:

Source: Transporeon Transport Execution

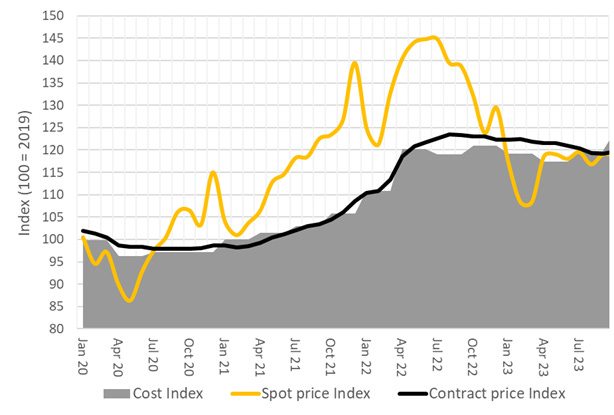

Those trends are not exclusive for Germany, they reflect well a European-wide situation. In contrast to spot with sharp decreases, longer-term (more than 12 months) contract rates mostly defended their levels reached. Our more detailed analyses indicate, that cross-border rates to/from Germany fell while domestic German rates remained relatively steady, mirroring the underlying cost developments of transport service providers.

Diesel fuel has been a bright spot, down (-5,6 %) year over year, with no supply or distribution disruptions foreseen.

Transport rates and costs development in Germany

Source: Transporeon Market Insights

The effects of the increased toll rates

The changes to the German toll structure, kicked on December 1, are poised to have a substantial impact. Traditionally representing about 11% of the average full truckload cost, this figure is projected to surge to around 18%.

Upon considering the impacts on transportation rates, our simulation, drawing from full truckload data collected from 55 shippers, indicates an average 6.5% overall increase for domestic German full truckload costs. With already slim operating margins, carriers will be unable to absorb this additional burden and will seek to pass it onto shippers.

These estimates apply to the linehaul costs and not to any pre and post carriage. Tolls also apply to re-positioning and empty kilometrage, which will pressure carriers in their negotiations to pass them along as well – success for compensation will be open and fragile. To mitigate this impact, carriers must strategically plan their routes and optimize fleet utilization to alleviate the toll burden.

The outlook

At present, there's no indication that the mounting cost pressures on carriers will alleviate any time soon. Should demand experience an upswing in 2024, it's anticipated that both spot and contract rates will follow suit and trend upwards. Conversely, if the current capacity levels persist alongside subdued demand, any rate increases are likely to be marginal.

Future data will reveal the extent to which German tolls drive rate levels and will provide insights into whether the toll adjustments will significantly influence the pricing dynamics in the European transportation industry.