Understanding Capacity Dynamics: How Truck Operational Efficiency Affects the Market

Market Monday - Week 9 - Operational efficiency decreased in 2024

In our previous analyses, we highlighted declining operational efficiency as a key factor worsening capacity constraints in the freight market. This critical issue deserves deeper examination.

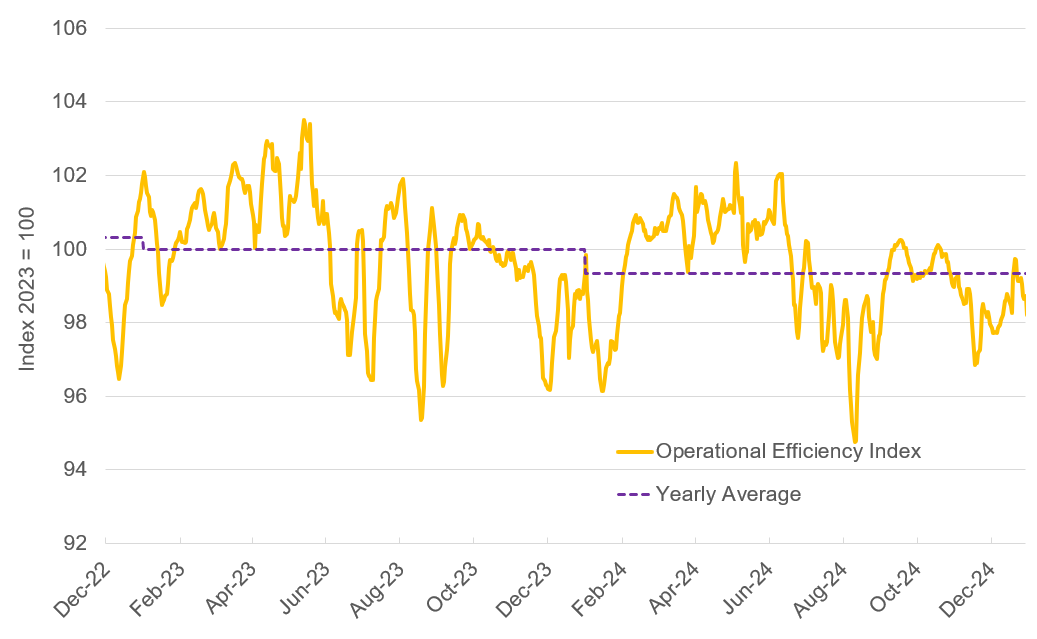

I am pleased to revisit the Truck Operational Efficiency Index - a KPI that measures carriers' operational productivity through daily distance driven and journey times.

This index offers valuable insights into market capacity dynamics.

Source: Trimble Transportation

This index typically shows minimal volatility since it directly reflects trucks' productive output, using a 7-day moving average. Major fluctuations would signal severe market disruptions - something we hope to avoid. Values above 100 suggest improved efficiency (e.g., longer distances traveled or shorter time needed), while values below 100 show reduced efficiency.

The data confirms that 2024 ended with lower operational efficiency compared to 2023. A more detailed analysis reveals that in 2024, trucks required more time to cover roughly the same distances.

Multiple factors contribute to this reduced efficiency:

Increased congestion

Blocked routes (tunnels, motorways, bridges)

Adverse weather conditions

Road construction and maintenance

Border stops and checks (Germany, Netherlands)

Slow “steaming” (intentional reduction in speed)

Looking ahead to 2025, with the resurgence of border controls, huge infrastructural projects (e.g. Lueg bridge on Brenner) even maintaining 2024`s efficiency levels would be a positive sign for capacity. Let's examine how January`s data compares to the last year.

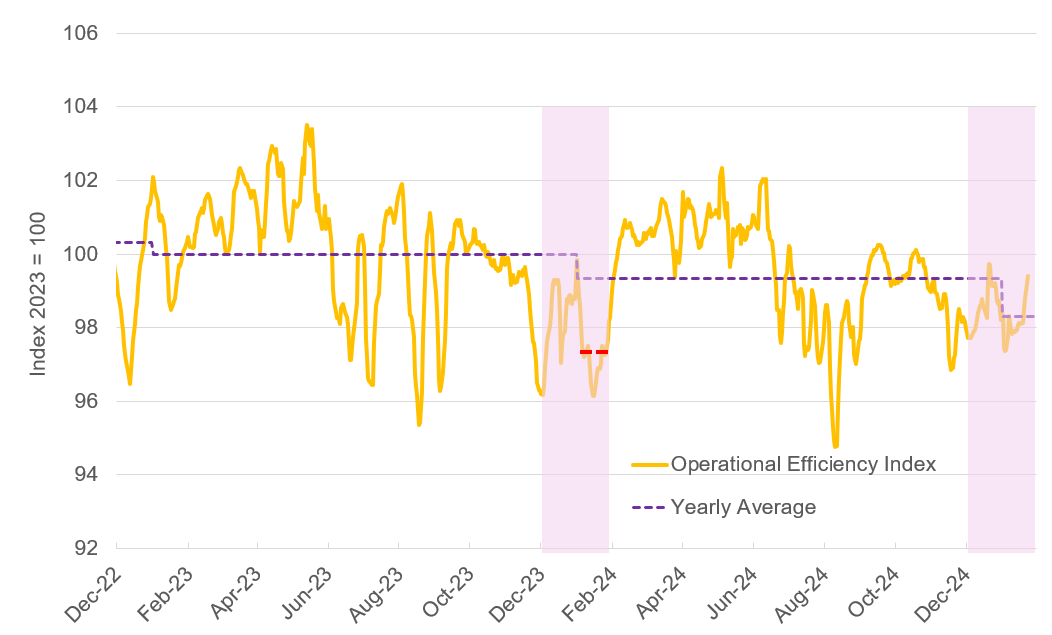

Source: Trimble Transportation

While the initial results may seem concerning, remember the yearly average currently reflects only January data. The dotted red line shows January 2024`s average, which is notably lower. However, I do not consider this development forecasting improving efficiency, yet. January`s public holidays - such as January 6th falling on Monday instead of a mid-weekday - were favorable for efficiency. In short, while conditions don't appear worse than 2024 so far, it’s too early to draw firm conclusions about changes.

Key implications for the market

While operational efficiency is just one of many market indicators, its impact on capacity dynamics is significant. The current decline in efficiency creates a cascading effect: carriers face higher operational costs and reduced productivity, which leads to tighter capacity and potentially higher rates. This ultimately affects the entire supply chain ecosystem, from shippers managing their logistics budgets to consumers experiencing potential delays or price increases.

We'll keep an eye on this index and share updates on how it relates to other market trends we're tracking. This will give us a clearer picture of what's really happening in the freight market.

Christian Dolderer

Lead Research Analyst

Transporeon