Understanding Road Transportation in Italy

Market Monday - Week 23 - Facts, figures and insights into road transportation in Italy.

About this series

The European transportation market is a diverse and complex landscape, encompassing over thirty distinct countries, each with its unique characteristics. In this series, we delve into the most significant transport markets in Europe, providing insights and comparisons.

The data presented is mainly based on activities from the Transporeon platform and official sources such as Eurostat. Unless otherwise described, the information relates to full truck load transport, but generally should also be applicable to other road transport segments to a similar extent.

The Italian road transportation market

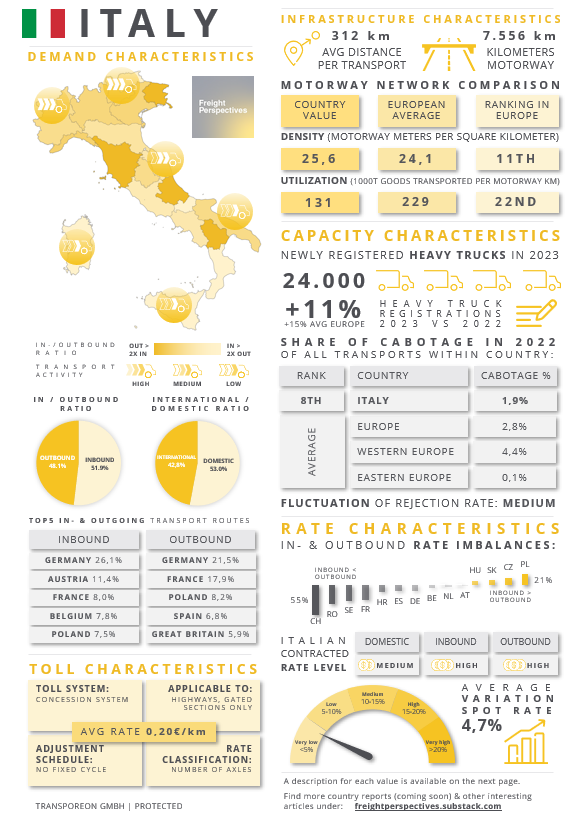

In 2022, Italy ranked as the fifth largest transportation market in Europe, with over 144 billion tonne-kilometers of goods transported according to Eurostat. It was only surpassed by Poland, Germany, Spain, and France. This makes Italy an attractive market for both international and local carriers, as well as freight forwarders. On the other hand, it also presents shippers with the challenge of securing the necessary capacity under favorable conditions.

In this article you can find an overview of the key characteristics of the Italian road transportation market. We also discuss how these individually impact shippers and carriers operating in the country.

Download the country overview in the highest available resolution including a description of all values:

Demand characteristics

Transportation demand in Italy is mainly influenced by its economic North-South-divide. The North and parts of central Italy, home to the majority of value-creating industries and large population, have a substantially higher demand for transportation than the South, including Sicily and Sardinia.

In 2023, the five most important countries for in- and outbound freight transports in Italy accounted for approximately 60% of all cross-border shipments. The percentage is significantly lower than the average among other major European countries. This implies that transports going in or out of Italy are less concentrated on specific countries, indicating dispersed demand for transportation.

These characteristics of the Italian transport market suggest that shippers operating in the Northern parts may face difficulties in finding the needed capacity. Carriers on the other hand may profit from the elevated demand in the North of Italy, where transportation rates are generally higher.

Toll characteristics

Italy uses a concession-based road operation system, with multiple operators charging tolls on different road sections. Toll costs can vary significantly depending on the route chosen, as some motorways are free-of-charge or have alternative paths to bypass expensive toll routes. The availability of toll-free alternatives depends on the specific route. Unlike countries like Germany, Italy currently has no announced plans to implement a CO2 portion.

As of May 2024, the estimated price of 0,20€ per toll-kilometer for a standard EURO6 truck with a trailer is typical in Western Europe. However, due to Italy’s extensive North-South stretch, toll costs represent a significant portion of the overall transport costs.

Infrastructure characteristics

Italy`s robust infrastructure comprises more than 7,500 km of motorways, promoting efficient transportation. Among larger European nations, it ranks third in motorway density, following Germany and Spain. However, the distribution of motorways is uneven. . While the North is traversed by well-developed motorways, the density of motorways decreases towards the South.

Apart from its motorways, Italy also has numerous state roads, which are usually free to use. However, these roads occasionally offer lower quality. Therefore the trade-off is between longer transit times with higher abrasion of the truck and the avoidance of toll costs.

Capacity characteristics

Italian freight forwarding companies possess one of the largest vehicle fleets in Europe. From 2019 to 2023, Italy ranked fifth for the highest number of new heavy trucks registrations, as reported by ACEA, representing approximately seven percent of the total European truck fleet. The trucks are primarily used for domestic transportation and bilateral transport with neighboring countries. Italian forwarders only conduct a relatively small portion of cabotage operations in other European nations.

With only 1,9%, the cabotage share of foreign freight forwarders in Italy is low compared to other Western European countries where the share can be up to five-times higher. It's important to note that a North-South-divide exists, with more cabotage services performed in Northern Italy. Freight forwarders based in Southeastern Europe could cross this region on their return journey, offering transport operations along the way.

Rate characteristics

Compared to other European countries, Italy's overall rate level is relatively high, with domestic transportation at medium level. Cross-border shipments, particularly outbound shipments to Western European countries, tend to be expensive. However, inbound rates from Western European countries are below their outbound values. Trade rates with Eastern European countries vary, without a clear trend in any specific direction.

For domestic transportation the North-South-divide also impacts the rate level. Transports from North to South are more expensive than those in the opposite direction. International transports ending in Northern Italy are more attractive due to the better backloading potentials, which should lead to shippers receiving more competitive offers for tenders to the Northern regions.

Conclusion

The characteristics of Italy`s road transportation sector are largely influenced by the economic structure of the country. The Northern regions, because of their higher demand and better developed infrastructure, impact the rate level and available capacity.

Shippers and forwarders in less active areas will face more challenges in optimizing their transportation network. They often have to accept discrepancies such as extended empty mileage for forwarders or limited supply of capacity for shippers.

If you have any suggestions, comments? We would highly appreciate your feedback. Please share your thoughts with us.

Lukas Guttmann

Senior Consultant

Lukas_Guttmann@trimble.com.

i would add seasonality. And impact of August holiday before and after.