Understanding Road Transportation in France

Market Monday - Week 46 - Facts, figures and insights into road transportation in France

About this series

The European transportation market is a diverse and complex landscape, encompassing over thirty distinct countries, each with its unique characteristics. In this series, we delve into the most significant transport markets in Europe, providing insights and comparisons.

The data presented primarily draws from activities from the Transporeon platform and official sources such as Eurostat. Unless otherwise described, the information relates to full truckload transport, but is typically applicable to other road transport segments as well.

The French road transportation market

France, as Europe's third largest economy by GDP, is a major hub for transportation. In 2022, the country handled an impressive 1.6 billion tons of goods, securing its position with the second highest volume of goods transported in the European Union after Germany.

As a Central European country, France serves as a crucial crossroads for East-West and North-South freight movements. As one of Europe's biggest transit countries, France and its legislation also influence international transports in Europe.

In this guide, we delve into the defining features of France's road transportation market. We'll examine how these characteristics impact shippers and carriers, providing key insights for businesses operating in this crucial market.

Download the country overview in the highest available resolution including a description of all values.

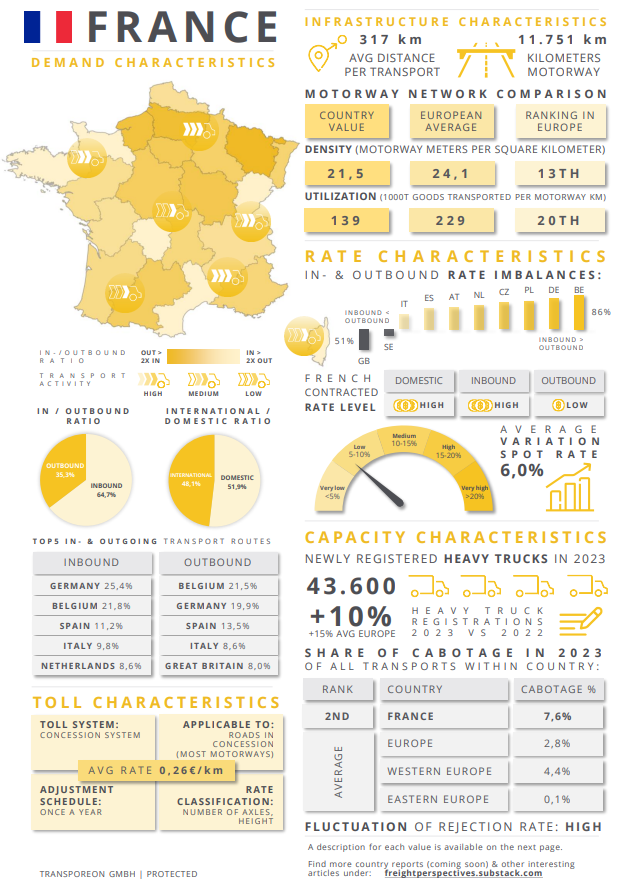

Demand characteristics

The demand for transport services in France is concentrated primarily in the country's economic hubs and densely populated areas. The northern and eastern regions, particularly around Paris, Lyon, and Lille, experience the highest levels of transport activity due to their substantial industrial presence. The port cities of Marseille and Le Havre serve as crucial intermodal and transshipment hubs.

Regional Distribution

Northern France: The Île-de-France region, including Paris, is the most significant area for transportation demand, due to its high population density and concentration of industries. The Hauts-de-France region, with cities like Lille, also sees substantial transport activity, driven by its proximity to Belgium and the UK.

Eastern France: The Grand Est region, including cities like Strasbourg and Metz, is another key area for transport demand, benefiting from its strategic location near Germany and Luxembourg.

Southern France: The Provence-Alpes-Côte d'Azur region, with Marseille as a major port city, plays a vital role in both domestic and international transport, particularly for goods entering and leaving the Mediterranean.

Cross-border shipments in France are heavily oriented towards the neighboring countries, with Germany and Belgium leading as France's most important trading partners for both inbound and outbound transports. Other significant trading partners include Italy, Spain, Netherlands, and the UK.

The transport market in France is heavily impacted by demand imbalances in between the different regions and particularly the neighboring countries. Notably, transports into France from Belgium and Germany substantially exceed those returning to these countries.

Toll characteristics

France boasts an extensive motorway network, known as "autoroutes," which operates under a sophisticated toll system. Primarily managed by private concession companies, this system is designed to maintain and improve the country's road infrastructure.

The toll charges are calculated based on two main factors: the distance traveled and the vehicle type. Heavier and more polluting vehicles typically incur higher fees, reflecting France's commitment to environmental sustainability. Toll booths, or "péages," are strategically placed along the motorways to collect these fees, with rates varying according to the specific route and operator.

To streamline the toll collection process, France has implemented an electronic toll collection system called "Télépéage," which allows vehicles to pass through toll booths without stopping. This system is widely used by commercial vehicles to save time and improve efficiency. As of 2023, the average toll cost (based on a 430km transport) for a standard EURO 6 truck is around 0.26€ per kilometer. But also fees between 0.30€ - 0.40€ per tolled kilometer are possible depending on the route and operator.

While the autoroutes form the backbone of France's road network, the country also maintains a system of national (N) and departmental (D) roads. These routes are toll-free and offer an alternative for carriers looking to reduce toll costs. However, this cost-saving strategy often comes with trade-offs, including longer transit times and increased vehicle wear and tear.

For carriers operating in France, toll costs represent a significant portion of the overall transport expenses particularly for long-distance hauls. Carriers must strategically plan their routes to optimize costs and efficiency as also specific bridges and tunnels at bottlenecks are tolled. Moreover, the high toll costs can also influence the pricing dynamics in the French transportation market.

Infrastructure characteristics

France's transportation network is an extensive, well-maintained system enabling efficient nationwide movement. At its core are approximately 12,000 km of tolled motorways (autoroutes) and 30,000 km of national roads (N roads), complemented by 378,000 km of departmental roads (D roads). The autoroutes in particular, stand out for their exceptional quality, featuring state-of-the-art facilities and adhering to stringent standards. Key transport corridors include major north-south routes like the A1 (Paris to Lille) and A7 (Lyon to Marseille), as well as east-west routes like the A4 (Paris to Strasbourg) and A10 (Paris to Bordeaux). These vital pathways not only connect France's major cities but also serve as critical links for international transport.

France's intermodal connectivity is further enhanced by its strategic maritime gateways. Major ports like Marseille, Le Havre, and Dunkirk, coupled with an extensive rail and air network, offer diverse transportation options. However, the distribution of intermodal terminals presents a challenge. While these facilities support efficient transfers between different modes of transport, their scarcity and concentration in the country's center limit the full potential of intermodal efficiency.

Despite its overall robustness, the French transportation system faces several challenges. Congestion in major urban centers like Paris and Lyon can cause significant delays. Ongoing maintenance and modernization projects, while necessary for long-term improvement, often result in short-term disruptions to traffic flow. Perhaps the most significant hurdles are the natural barriers posed by the Alps and Pyrenees. These mountainous regions create bottlenecks that complicate road transport, leading to increased transit times and operational costs. The situation is exacerbated when key passages, such as the Frejus tunnel, are closed for maintenance, modernization, or due to accidents. The limited number of viable routes through these areas could result in severe congestion, particularly during peak travel seasons and adverse weather conditions.

Capacity characteristics

According to ACEA, nearly 210,000 new heavy trucks were registered in France over the past five years, ranking as the second largest in Europe. This extensive fleet primarily serves domestic transportation with a minor role in bilateral transport with neighboring countries. There are several big players active however, particularly the assets based (truck owning) companies are small resulting in a highly fragmented capacity supply. International carriers also maintain a significant presence, predominantly handling cross-border transports. Notably, their share in domestic transportation is on the rise, elevating France to the position of the second-largest cabotage market in Europe.

Despite the sizable fleet, capacity distribution across France is uneven. Northern and eastern regions, with their higher industrial activity and population density, experience higher demand and better capacity availability. In contrast, central, southern and rural areas often face capacity shortages, making it challenging for shippers to secure the necessary transport services in large quantities.

Seasonal fluctuations also impact capacity, with notable peaks in transport rejections throughout the year. For instance, capacity usually decreases during the summer holiday period and around major public holidays, leading to higher transport rates and increased competition for available trucks. Conversely, capacity generally peaks at the beginning of the year during periods of lower industrial activity.

In conclusion, while France benefits from a substantial and modern fleet, regional disparities and seasonal variations present ongoing challenges in optimizing transport capacity. The dynamic interplay between domestic and international carriers, coupled with evolving regulatory changes, continues to shape the capacity landscape in the French road transportation market.

Rate characteristics

France's contract rates for domestic and inbound traffic are notably higher compared to other European countries, while outbound rates are comparatively lower.

Rates can vary significantly depending on the destination or origin country. Generally, eastbound transports command lower rates than westbound ones. This creates cost-effective opportunities for shipping goods to Eastern European countries like Poland and Czechia, as carriers often seek backhaul opportunities here. Conversely, transports to countries like Great Britain and the Nordics tend to be more expensive due to fewer return shipments to France.

Overall, a general imbalance in flows between France and other countries,as well as within France itself, significantly influences transport rate levels.

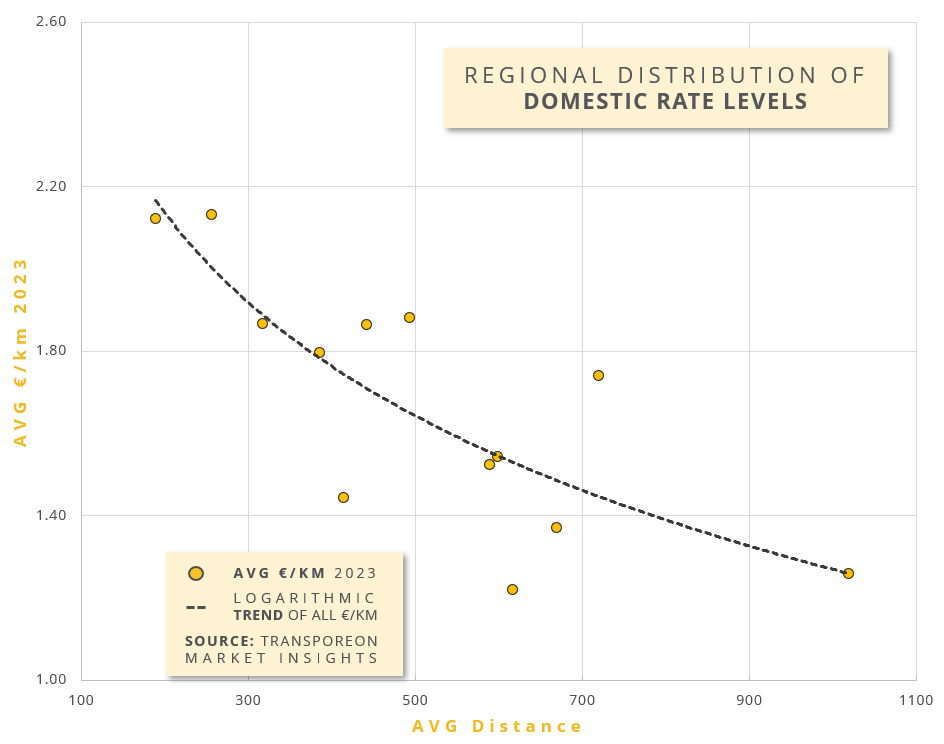

To illustrate these trends, we've compiled data on average €/km rates for contracted standard FTL (Full Truckload) transports at their average distances between different regions in 2023. Detailed values can be found in Transporeon Market Insights:

Source: Transporeon Market Insights

As one might expect, the cost per kilometer decreases as the distance increases across all regions in France. However, huge differences exist even for similar distances. Within regions, the data confirms lower price levels for transports heading east or north. This pattern can be attributed to the aforementioned general imbalances and of course the central economic role of the Île-de-France region. Interestingly, transports from southeastern France show the lowest price levels, while those from central and more rural areas tend to be higher.

Conclusion

France's road transportation market stands as a pivotal hub in Europe, driven by its significant economic activity and geographical position. The demand for transport services is primarily concentrated in the industrially rich northern and eastern regions, with Paris, Lyon, and Lille at the forefront. While there is substantial demand for domestic and cross-border transportation, a significant portion of these services is fulfilled by foreign carriers. This reliance on non-French carriers plays a crucial role in meeting capacity needs and maintaining competitive rate levels in the market.

Several factors contribute to France's attractiveness for foreign carriers, particularly those from Eastern Europe operating in Western Europe. These include France's central location within Europe, its thriving manufacturing sector, high achievable prices and its well-developed infrastructure.

Christian Dolderer

Lead Research Analyst

Transporeon