Understanding Road Transportation in Poland

Market Monday - Week 41 - Facts, figures and insights into road transportation in Poland

The European transportation market has a diverse and complex landscape, encompassing over thirty distinct countries, each with its unique characteristics. In our recurring series of reports and articles, we delve into the most significant transport markets in Europe, providing insights and comparisons.

The presented data is mainly based on activities from the Transporeon platform and on public data sources such as Eurostat. Unless stated otherwise, the information is mostly relevant for Full Truck Load (FTL) transports, but may to some extent also be applicable to other road transport segments.

Today’s focus is on Poland. We will provide you with an overall country profile from a transportation perspective as well as a deep dive into how Polish specifics affect outside markets.

Polish road transportation market

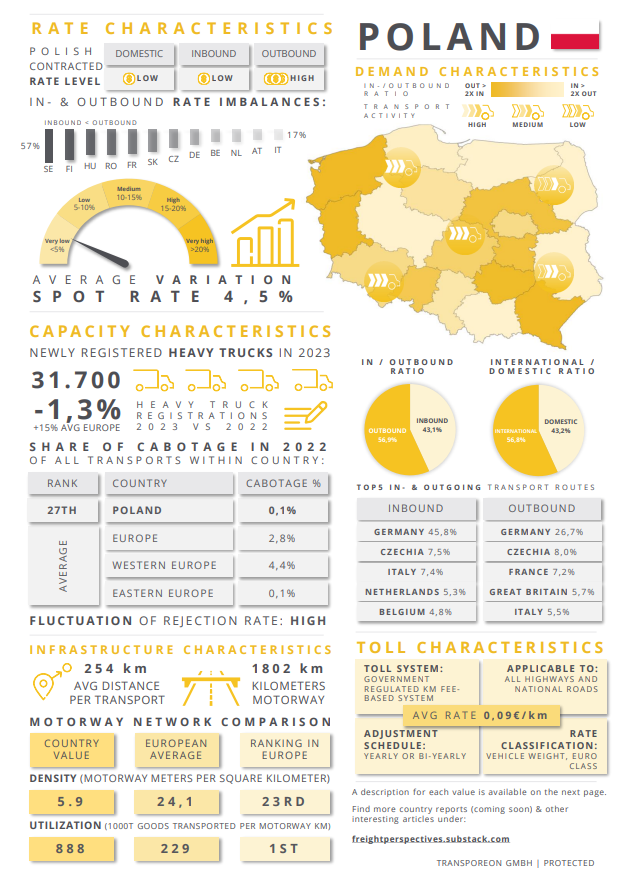

After a disappointing rise of only 0.2% in 2023, Poland's economy in 2024 is expected to see GDP growth of 2.8%, thanks to private and public consumption stimulated by rising wages and social support. This will keep Poland firmly in 6th place in the GDP rankings within the EU. Inflation is projected to ease from +10.9% to more appropriate +4.3% in 2024.

Despite the place in the GDP rankings, Poland leads the EU in cumulative road freight rankings with over 385 billion tonne-kilometres in 2022, according to Eurostat data. The first place is a result of the historical prominence and activity of Polish transport carriers on the European road transport scene.

Poland is a rare case where registrations were lower in 2023 vs 2022, as the industry started to feel the impact of driver shortage, Mobility Package and overall economic downturn, with local carriers being cautious in expanding or modernizing their fleet.

Download the country overview in the highest available resolution including a description of all values:

Demand characteristics

The demand for transport services in Poland is primarily concentrated in the country's economic areas with higher population density. The western and southern parts of Poland, particularly regions around Warsaw, Kraków, Wrocław, and Poznań, see the highest levels of transport activity due to their substantial industrial presence and developed infrastructure. The port cities of Gdańsk and Gdynia in the North are crucial for intermodal transport as major transshipment hubs.

Cross-border shipments in Poland are heavily oriented towards Germany, which is Poland's most important trading partner for both inbound and outbound transport, with next Czechia, Italy and BeNeLux countries playing important roles as cargo movement partners as well.

Additionally, Poland has a higher than average ratio of international to domestic transport in Europe. This is largely driven by the country's strategic location at the crossroads of major European trade routes and decent integration of the economy with EU neighbors, supported by activities of local carriers engaging long-distance transport. Seasonal demand patterns include peak seasons leading to major holidays like Christmas and Easter followed by sharp drops in demand for several days of festivities.

Toll characteristics

Poland employs a national system e-TOLL where toll costs are determined based on driven kilometers. The government’s system covers about 3621 km of the local highways and expressways. In addition, some sections of highways A1, A2, A4 are under concessions and are tolled separately via AutoPay and AmberOne systems. Poland is yet to follow the German example and implement a CO2-based tolling system and no definite plans for this implementation were announced so far.

With a price of approximately 0,09€ per toll-kilometer for a standard FTL truck, average toll costs in Poland are on the cheaper side of toll costs in countries which utilize km-based distance calculations.

Infrastructure characteristics

Despite Poland's relatively sparse motorway network, spanning approximately 5,100 km of highways and expressways, the country manages to maintain decent accessibility. While Poland ranks below average in the EU for highway network utilization, its square-like shape and predominantly flat terrain work to its advantage and ensure that most regions enjoy reasonable access to the existing highway infrastructure.

Besides highways (A designation), Poland also has a robust supporting network of expressways (S designation), which have lower maximum speed limits and access standards. It is worth noting that the expressways network is in an intensive construction and renovation phase, especially in Eastern and Northern Poland regions for the next 3-4 years, with strategic plans existing to further expand the network by 1000-2000 km of highway and expressway roads in early 2030s.

Capacity characteristics

Polish carriers are universally present on the European transport landscape, absolutely dominating the domestic market and boasting a significant footprint on international road transportation in general. After the initial expansion phase in 2000-2012, Polish carriers entered a consolidation and optimization phase, allowing them to reach Germany in the total number of large transport carriers (250+ employees), but still more than 6000 mid-sized carriers with 10+ truck fleets remain active.

In 2023-2024 reports indicate that many of the smaller carriers are being pressured by rising costs, so further consolidation of the market seems inevitable as well as a considerable number of exits from smaller and less financially stable carriers. These changes stem from two key factors. First, the EU Mobility Package implementation has constrained Polish carriers' advantages in cabotage and international routes. Second, a widespread driver shortage across Europe has significantly impacted Poland, with estimates suggesting between 30,000 and 50,000 unfilled driver positions in the country.

Rate characteristics

Polish domestic rates are comparably low in comparison to other EU countries, but have shown a tendency for slow but steady increases within 2024.

International transport rates to and from Poland demonstrate large disparity: inbound rates are significantly cheaper than outbound, with differences reaching over 50% on some routes.. This imbalance is present on routes from Poland to most directions, let it be Western, Northern or Southern Europe and it is deeper during peak seasons preceding major national holidays. This situation is dictated by the large presence of Polish carriers on international routes and their willingness to accept lower rates en route to the home base.

Conclusion

Road transport is a cornerstone of the Polish economy, showcasing remarkable growth historically and constituting a significant portion of the country's economy now with circa 500,000 workers employed in the sector.

However, the industry now faces a plethora of challenges. EU Mobility Package has shaken up operations, while an aging workforce threatens long-term stability. Economic uncertainties and geopolitical tensions further complicate matters, impacting costs and efficiency. Yet, Polish transport companies are proving their resilience, maintaining a strong presence in the EU market through innovation and adaptation.

Looking to the future, Poland's road transport sector is embracing greener technologies. The adoption of biodiesel and electric vehicles is on the rise, signaling an ongoing shift towards sustainable solutions. However, significant investment in infrastructure is still needed to meet EU-wide decarbonization goals. As the industry navigates these changes, it continues to demonstrate its crucial role in Poland's economic landscape.

Oleksandr Kulish

Transporeon Market Intelligence

oleksandr_kulish@trimble.com

Do you have these statistics also for the austria market?