Understanding Road Transportation in Germany

Market Monday - Week 34 - Facts, figures and insights into road transportation in Germany

About this series

The European transportation market is a diverse and complex landscape, encompassing over thirty distinct countries, each with its unique characteristics. In this series, we delve into the most significant transport markets in Europe, providing insights and comparisons.

The data presented is mainly based on activities from the Transporeon platform and official sources such as Eurostat. Unless otherwise described, the information relates to full truck load transport, but generally should also be applicable to other road transport segments to a similar extent.

The German road transportation market

Germany, as Europe's largest economy by GDP, is a major hub for transportation. In 2022, over three billion tons of goods were transported in Germany, making it the country with the highest volume of goods transported in Europe. It also has the second-highest number of ton-kilometers driven, second only to Poland.

As the largest of the central countries in Europe, many transports traveling East-West or North-South cross Germany on their way through Europe. As Europe's biggest transit country, Germany and its legislation also influence a significant portion of international transports in Europe.

In this article you will find an overview of the key characteristics of the German road transportation market. We also discuss how these individually impact shippers and carriers operating in the country.

Download the country overview in the highest available resolution including a description of all values:

Demand characteristics

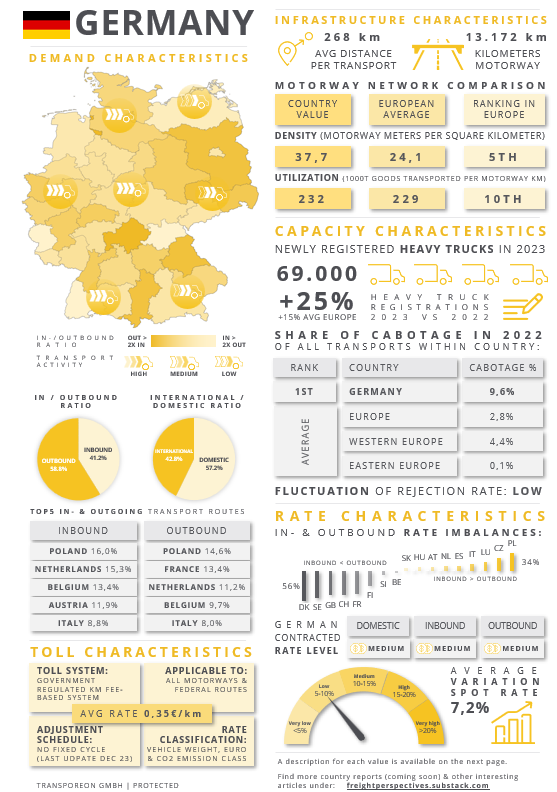

Distribution of demand across the country's regions is concentrated in economic zones and areas with higher population density. Transport activity is typically higher in the western parts of the country compared to the east. However, major cities like Munich and Leipzig see significant transport activities due to the substantial industrial presence in their suburban areas.

Germany boasts one of the highest ratios of domestic to international transport in Europe. This is largely due to the country's size, which offers more opportunities for domestic trade. In contrast, smaller countries must rely more on international trading partners due to their limited domestic markets.

Cross-border shipments in Germany are more evenly distributed compared to other European countries. Based on Transporeon platform data, Poland is Germany's most important trading partner for both inbound and outbound transport. However, with shares of 16% and 15% respectively, these proportions are relatively low compared to other European countries, where the primary trading partner often accounts for 20% to 30% of trade.

The characteristics of German transportation demand suggest that carriers will find a large supply of shippers needing transports in larger urban and suburban areas. Conversely, in rural regions like the Northeast, the demand for transport is lower, making it difficult to find backloading opportunities. Generally there is no clear characterization in demand patterns for Germany in comparison to Italy or France which account for clearly very strong and weak regions.

The seasonal demand of different regions in Germany is also impacted by various schedules of public holidays and school holidays within the federal states of Germany. Depending on the location, the summer school holidays, when plant closures typically occur, can differ by region between early June and mid-September.

For shippers, this generally means that in regions with significant imbalances between inbound and outbound transport, finding the needed capacity can be challenging. However, in areas with a surplus of capacity in the opposite direction, lower transportation rates can be achieved.

Toll characteristics

In Germany, tolls are collected on all federal highways and motorways, covering 51.000 km, by the state-owned company Toll Collect. The toll rates are uniform across all tolled routes and are determined based on the number of axles, vehicle weight, and the vehicle's EURO and CO2 emission classifications. Starting from July 1, 2024, all vehicles with a weight above 3,5 tons are required to pay tolls.

Since the implementation of the CO2 component in December 2023, the German toll has become one of the highest in Europe for diesel-powered trucks. With a cost of 0,35€ per kilometer for a standard EURO 6 5+ axles truck, the German toll represents a significant expense for transports to, from, or through Germany. This is particularly impactful as many major East-West and North-South routes in Europe pass through Germany.

Infrastructure characteristics

In 2022, Germany had a motorway network spanning 13,000 km, making it the second largest in Europe after Spain. Additionally, there are 38,000 km of federal highways, which often match the quality of official motorways, together creating a dense network for fast travel across the country. Consequently, Germany has the highest ratio of motorway kilometers relative to its size among the larger European countries.

Due to Germany's central location in Europe, its economy, and its population, the motorway network is heavily utilized by both private and commercial vehicles, especially on key North-South and East-West routes. Due to lower investments into new infrastructure or renewing existing ones in recent decades, many motorway bridges are reaching their end of life. Therefore, many bridges have speed reductions in place or are closed to heavy trucks.

A renewal and modernization of the infrastructure will negatively affect traffic, with more road closures and congestion expected in the coming years. The high utilization, combined with ongoing construction projects, led to 733,000 kilometers of traffic jams in 2022, according to the ADAC (Allgemeiner Deutscher Automobil-Club), Germany's largest automobile club. This translates to an average of 56 traffic jams per kilometer of motorway, where the route was blocked or only usable only to a limited extent.

Germany is divided into sixteen federal states, each of which can independently determine their own public holidays, aside from nationwide holidays such as Christmas on December 25th and 26th. On public holidays, companies are prohibited from conducting road transports, including empty mileage. Consequently, if a public holiday occurs in one region but not others, trucks may need to take longer routes on certain days to cross Germany as usual.

Capacity characteristics

According to ACEA, nearly 300,000 new heavy trucks were registered in Germany over the past five years, accounting for 20% of all European registrations. This makes Germany's fleet the largest in Europe. Due to its high demand for domestic transportation, this fleet is primarily used for domestic shipments and trade with neighboring countries.

Despite this, Germany has the highest percentage (9,6%) of domestic transports performed by foreign freight forwarders, indicating a significant reliance on non-German registered carriers to meet the country's capacity needs. Germany's central location in Europe makes its transportation market particularly attractive to Eastern European freight forwarders, who often carry out cabotage operations while en route to or from other Western European countries. However, tightened EU regulations, such as the Mobility Package, have recently limited this practice, indirectly affecting freight rate levels.

The available capacity in the German transport market typically follows seasonal patterns, unless disrupted by major events such as the COVID-19 lockdowns. At the beginning of the year, there is generally more available capacity, which then decreases during the Easter holidays. After a short recovery, capacity hits its lowest point during the public holidays in May and June. In July and August, when many companies, especially in the automotive industry, slow down for the summer holiday period, capacity initially increases but then drops again as production picks-up in late summer. During autumn and early winter, capacity generally rises until the weeks before Christmas, when the market typically experiences another low point in available capacity.

Rate characteristics

Germany's contract rates for domestic, inbound, and outbound shipments are average when compared internationally. Despite high transportation costs, including driver wages, fuel, and a significant toll increase since December of last year, rate levels remain relatively low. This is partly due to the high percentage of cabotage operations conducted by foreign carriers, increasing competition, especially in sectors with fewer equipment requirements. Many local, highly specialized carriers also offer competitive services, often maintaining long-term relationships with a stable pool of shippers.

Rates can vary significantly depending on the destination or origin country. For instance, it is cheaper to transport goods to Eastern European countries like Poland and Czechia than from these countries, as Eastern European carriers seek backhaul opportunities and accept lower rates. Conversely, transports to countries like Great Britain and the Nordics are more expensive due to fewer return shipments to Germany.

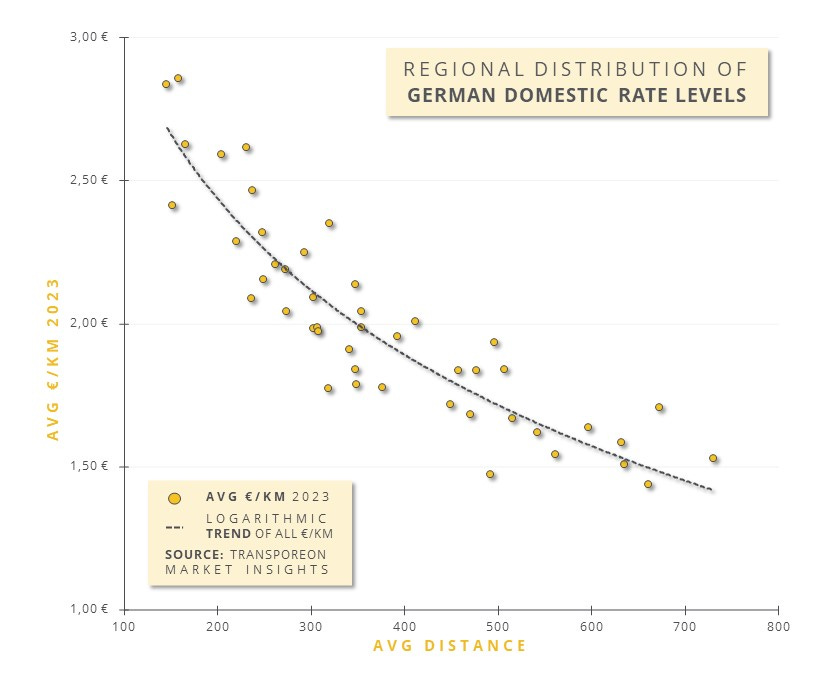

Domestic transport shows a similar trend. The following chart displays the average €/km rates for contracted standard FTL transports between different regions of Germany in 2023. Detailed values can be found in Transporeon Market Insights:

Source: Transporeon Market Insights, own analysis and illustration

As expected, the cost per kilometer decreases with increasing distance across all regions in Germany. However, significant differences exist even for identical distances. Between regions, the data shows that the price level is higher in Western Germany compared to Eastern Germany. This can be attributed to the proximity of Eastern regions to Poland and the Czech Republic, where local transport is sometimes handled by lower-cost freight forwarders from these countries. For East-West connections, transport from East to West is more expensive than the reverse, driven by higher demand for transports into Western Germany compared to the East.

Conclusion

Germany's transportation market is characterized by a unique blend of high domestic demand and significant international involvement. While there is substantial demand for domestic transportation, many of these transports are handled by foreign carriers through cabotage. This means Germany relies on non-German carriers to meet capacity needs and maintain average rate levels. Germany´s central location in Europe, along with its strong manufacturing sector and extensive infrastructure, makes it an attractive market for foreign carriers, especially those from Eastern Europe, operating in Western Europe.

If you have any suggestions or comments? We would highly appreciate your feedback. Please share your thoughts with us.

Lukas Guttmann

Senior Consultant