What's Under the Hood of Transport Demand in the Automotive Industry

Market Monday - Week 33 - Promise of recovery from a key sector of the European economy

The automotive industry is one of the key components of Europe's economic success, directly or indirectly employing millions of people in thousands of companies across the continent. Recently, this sector has been experiencing major shifts from moving towards electrification and stricter environmental rules while experiencing COVID restrictions, supply chain deterioration and economic turmoil periods.

Harsh requirements set by the EU's "Green Deal" and tightening CO2 emission standards forced European automakers to shift their focus from traditional internal combustion engines to battery electric vehicles (BEVs) and hybrids, involving billions of euros in investments in new models' R&D, battery megafactories and dedicated production platforms. While early efforts led to a surge in BEV sales, recent new vehicle production figures indicate a slowdown in growth in this segment, likely caused by a combination of increasing costs, rising interest rates, phasing out of government subsidies in major markets and fierce competition with emerging international manufacturers. These new competitors often offer technologically comparable and competitively priced models, challenging the market shares of leading brands and manufacturers across the world. The European automotive sector has bet on innovation and adaptation, investing heavily in the development of autonomous driving technologies, connected car services, and new manufacturing methods.

These developments directly impact numerous transportation and logistics companies serving the Automotive industry, making it crucial to analyze how these changes are impacting the demand for automotive transport services and the market as a whole.

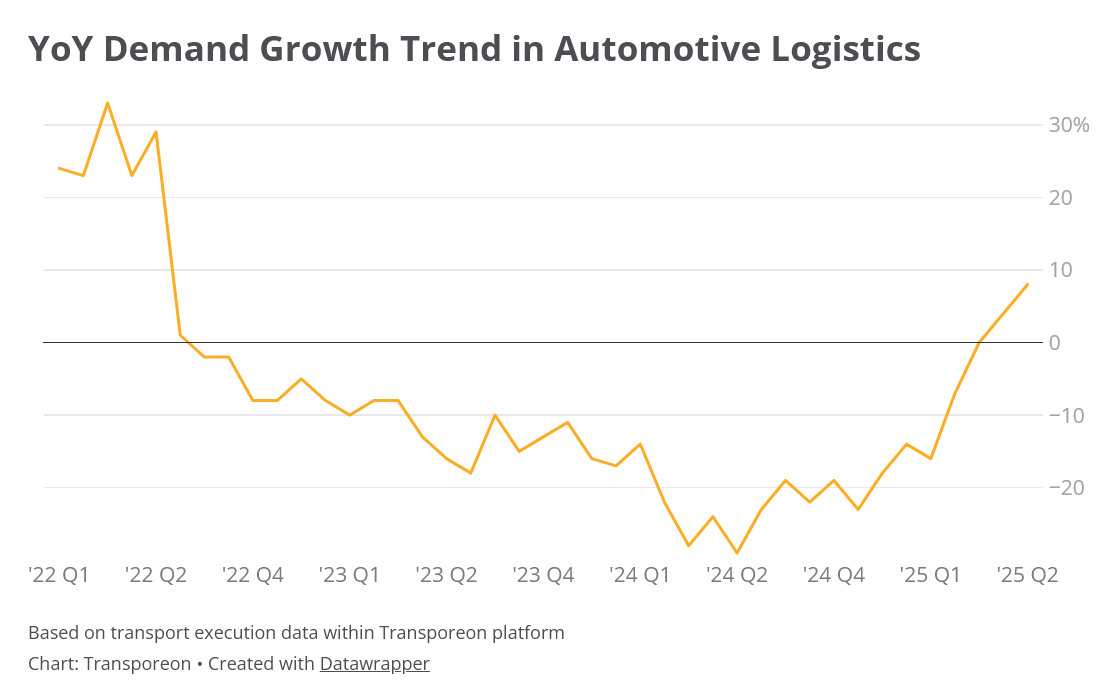

Available transport demand data for the automotive industry within Transporeon closely follows the mentioned developments. The chart below shows the mentioned industry's ups and downs for the last four years.

Following the initial shock of the pandemic, the automotive sector experienced a robust recovery in logistics demand. This was driven by a combination of pent-up consumer demand for vehicles and OEMs' efforts to work through production backlogs that had accumulated due to supply chain disruptions. However, the momentum soon began to falter. From 2022 through the end of 2024, the industry's transport demand experienced ten consecutive quarters of negative YoY growth, hitting the bottom in mid-2024.

The data for the first two quarters of 2025 suggests a potential turnaround point. The rate of decline began to moderate significantly in the first quarter. By the second quarter of 2025, the trend reversed, with demand registering positive YoY growth for the first time since mid-2022. While these figures are modest, they signal that the worst of the contraction may be over and that a fragile recovery could be underway. As European manufacturers continue to adapt and innovate, analysing the evolution of the freight market will help us to look forward, revealing if this fragile industry rebound can keep its pace against global competition.

Oleksandr Kulish

Senior Consultant