A Tale of Two Recoveries: How Germany's Lagging Industries Diverge from European Transport Trends

Market Monday - Week 42 - Insights into the European transportation demand

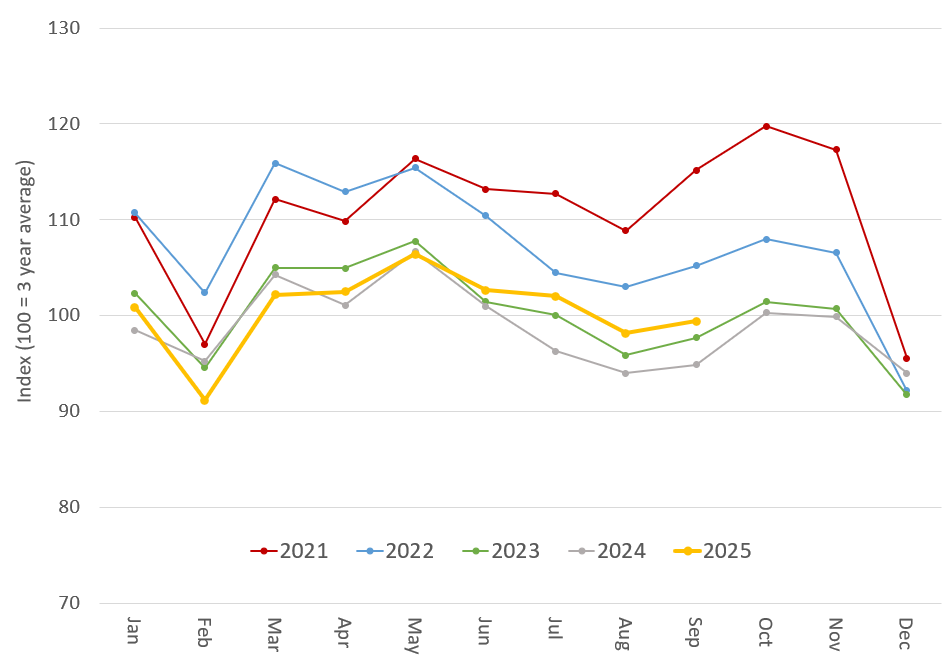

The promising signs of economic recovery seen in July 2025 have not been sustained, at least according to one key indicator. The German toll mileage index, a measure of heavy truck transport developed by Germany’s Federal Office for Logistics and Mobility (BALM), has reverted it’s increasing trend discussed in early August.

The significant July increase, which had no precedent in the last four years, now appears to have been a temporary outlier. The index has since corrected its course and aligned again with the 2023/2024 average. The most likely explanation is no longer a fast general recovery but rather a one-off event, with tariff-induced frontloading effects being a primary candidate for the significant uptick monitored.

For more clarity and visual simplification, I’ve combined 2021 and 2022 as well as 2023 and 2024. The dotted lines represent the yearly values, which vary only marginally.

While Germany is first and foremost the largest economy in Europe and second, a key transit country, this KPI mainly measures Germany’s industrial success and only partially the European transportation demand.

Transporeon’s European transportation demand KPI, based on all European shipments on our platform, is less Germany-centric and shows a different picture. Demand in August and September was significantly above 2024 and 2023 levels. Of course, the reasons are more nuanced than simple geographic coverage. Industry sector distribution surely matters, and here, with Chemical (-0,4%) and Automotive (+0,5%) only around or slightly below 2024 levels, another potential reason for the emergence of opposite development, as these industries are heavyweights in Germany and showed the weakest YoY performance in transportation demand.

European transportation demand

Source: Transporeon Market Insights

Returning to the significant uptick in July 2025 and the departure from the 2024 trajectory supports my perception of an extraordinary July and, to some extent, an eye towards further future transportation demand increases.

However, this data and its mixed picture also prove that the current market direction is fragile and that the economy is not yet on a robust growth trajectory.

Christian Dolderer

Lead Research Analyst

Trimble Transportation (Transporeon)